For the 24 hours to 23:00 GMT, the EUR declined 0.38% against the USD and closed at 1.0888.

On the economic front, the Euro-zone’s seasonally adjusted flash gross domestic product (GDP) rose 0.5% on a quarterly basis in the first quarter of 2017, meeting market expectations, thus supporting the notion that the economy is getting back on track again. In the prior quarter, GDP had climbed by a revised 0.5%.

Elsewhere, in Germany, the seasonally adjusted unemployment rate remained steady at 5.8% in April, in line with market expectations.

The greenback traded higher against a basket of currencies after the US Federal Reserve (Fed) left the door open for a June interest rate hike.

The Fed, at its latest monetary policy meeting, opted to leave key interest rate unchanged in a range from 0.75% to 1.0%. In the statement accompanying the decision, the Fed played down weak first-quarter economic growth in US, stating that the recent slowdown was “likely to be transitory” and emphasised the strength of the nation’s labour market and consumer spending. Moreover, the central bank characterised inflation as “running close to the central bank’s 2.0% target.”

Earlier in the session, the greenback strengthened against its major counterparts, on the back of upbeat US economic data.

The US ISM non-manufacturing PMI advanced more-than-anticipated to a level of 57.5 in April, compared to market consensus for a rise to a level of 55.8 and following a level of 55.2 in the previous month. Also, the nation’s final Markit services PMI unexpectedly climbed to a level of 53.1 in April, after recording a drop to a level of 52.5 in the preliminary print and compared to a reading of 52.8 in the previous month.

Other economic data showed that the US private sector employment increased by 177.0K in April, surpassing market expectations of an advance of 175.0K. However, it was the smallest gain since October 2016. The private sector employment had registered a revised gain of 255.0K in the previous month. In contrast, the nation’s MBA mortgage applications eased 0.1% in the week ended 28 April 2017. Mortgage applications had risen 2.7% in the prior week.

In the Asian session, at GMT0300, the pair is trading at 1.0891, with the EUR trading slightly higher against the USD from yesterday’s close.

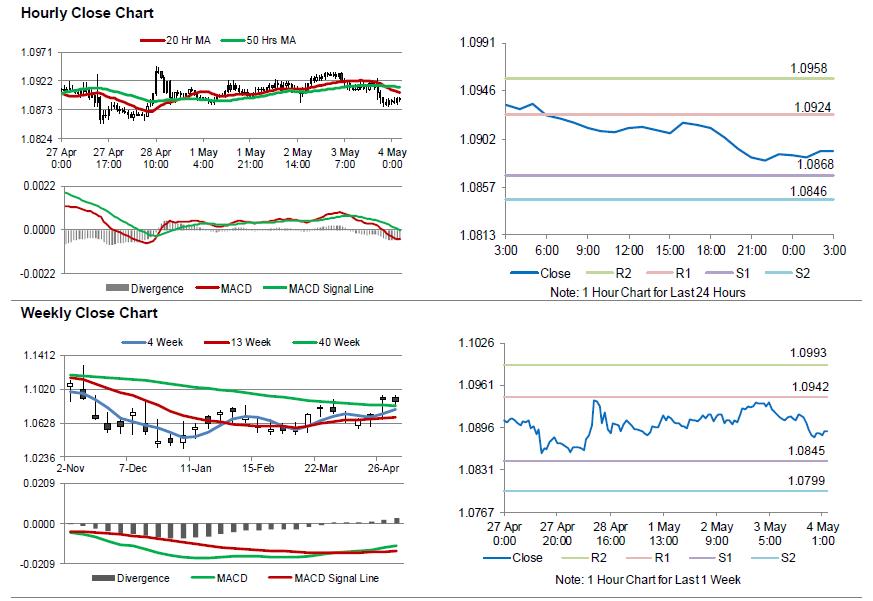

The pair is expected to find support at 1.0868, and a fall through could take it to the next support level of 1.0846. The pair is expected to find its first resistance at 1.0924, and a rise through could take it to the next resistance level of 1.0958.

Moving ahead, investors will closely monitor the final print of Markit services PMI for April across the Euro-zone along with the Euro-zone’s retail sales data for March, slated to release in a few hours. A speech by the ECB President, due later in the day, will also be eyed by traders. Additionally, the US trade balance, final durable goods orders and factory orders, all for March, set to release later today, will garner significant amount of market attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.