For the 24 hours to 23:00 GMT, the EUR declined 0.54% against the USD and closed at 1.1782 on Friday, after the Euro-zone’s economy contracted at its fastest pace on record in the second quarter.

On the macro front, Euro-zone’s gross domestic product (GDP) plunged 12.1% on a quarterly basis in the second quarter of 2020, recording its biggest single quarter drop in history and more than market expectations for a drop of 12.0%. In the prior quarter, GDP had recorded a fall of 3.6%. Meanwhile, the consumer price index unexpectedly rose 0.4% on a yearly basis in July, compared to a rise of 0.3% in the previous month. Separately, Germany’s retail sales climbed 5.9% on a yearly basis in June, surpassing market expectations for a rise of 3.0% and compared to a revised rise of 3.2% in the earlier month.

In the US, personal income slid 1.1% on a monthly basis in June, beating market expectations for a drop of 0.5% and compared to a revised fall of 4.4% in the previous month. Moreover, the Michigan consumer sentiment index dropped to 72.5 in July, compared to a reading of 78.1 in the prior month. The preliminary figures had indicated a drop to 73.2. On the flipside, personal spending climbed 5.6% in June, more than market expectations for a rise of 5.5% and compared to a revised increase of 8.5% in the prior month. Additionally, the Chicago Purchasing Managers’ Index advanced to 51.9 in July, more than market forecast for a rise to a level of 43.9 and compared to a reading of 36.6 in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.1773, with the EUR trading 0.08% lower against the USD from Friday’s close.

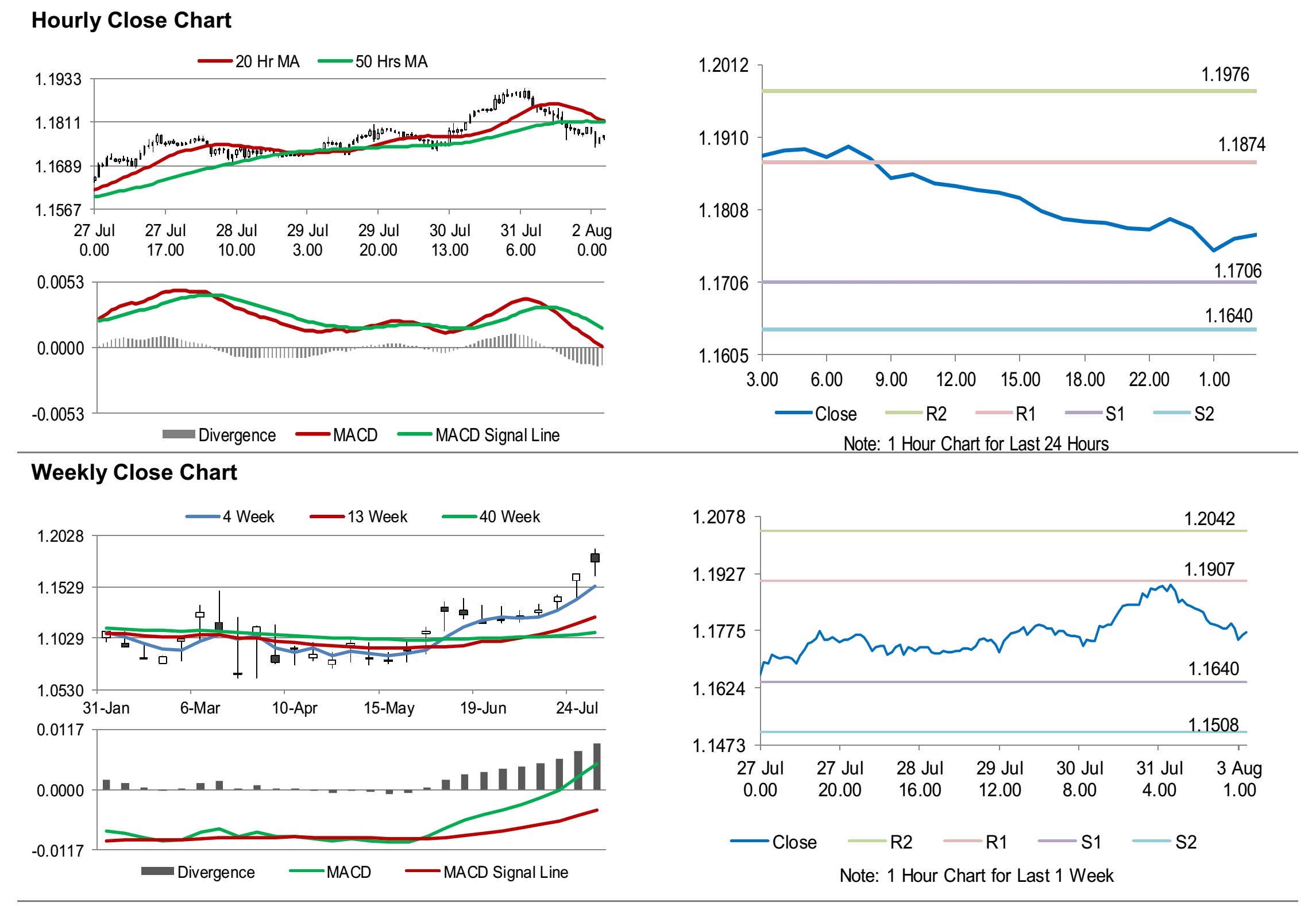

The pair is expected to find support at 1.1706, and a fall through could take it to the next support level of 1.1640. The pair is expected to find its first resistance at 1.1874, and a rise through could take it to the next resistance level of 1.1976.

Moving ahead, traders would keep a watch on the Markit manufacturing PMIs for July, slated to release across the euro area in a few hours. Later in the day, the US Markit manufacturing PMI and the ISM manufacturing PMI, both for July, along with construction spending for June, would keep investors on their toes.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.