For the 24 hours to 23:00 GMT, the EUR rose 0.23% against the USD and closed at 1.1106.

On the data front, Euro-zone’s seasonally adjusted final gross domestic product (GDP) rose 0.2% on a quarterly basis in 3Q 2019, in line with market expectations and confirming the preliminary figures. In the previous quarter, GDP had registered a similar rise. Moreover, the region’s seasonally adjusted retail sales advanced less-than-expected by 1.4% on a yearly basis in October, compared to a revised rise of 2.7% in the previous month. Market participants had envisaged retail sales to register an increase of 2.2%.

Separately, in Germany, seasonally adjusted factory orders unexpectedly declined 0.4% on a monthly basis in October, defying market consensus for an increase of 0.3%. In the preceding month, factory orders had recorded a revised rise of 1.5%.

In the US, data showed that trade deficit narrowed to a 16-month low level of $47.2 billion in October, amid drop in Chinese imports and less than market anticipations for a deficit of $48.7 billion. In the prior month, the nation had posted a a revised deficit of $51.1 billion. Further, the nation’s factory orders advanced 0.3% on a monthly basis in October, rising for the first time in three months and at par with market expectations. In the previous month, factory orders had registered a revised fall of 0.8%. Also. the final durable goods orders climbed 0.5% on a monthly basis in October, compared to a revised decline of 1.4% in the prior month. The preliminary figures had indicated a rise of 0.6%. Additionally, the seasonally adjusted US initial jobless claims unexpectedly dropped to a seven month low level of 203.0K in the week ended 29 November 2019, defying market anticipations for a rise to a level of 215.0K. Initial jobless claims had registered a level of 213.0K in the previous week.

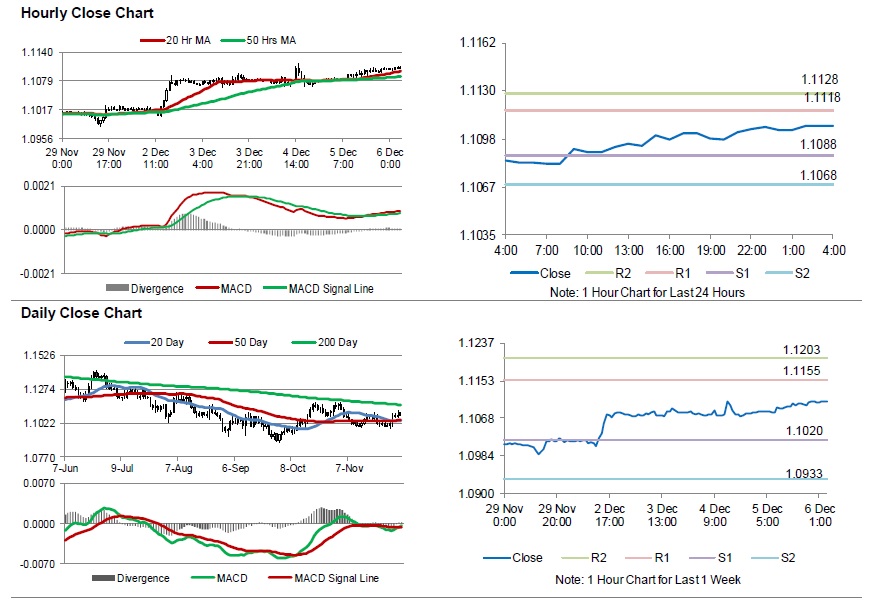

In the Asian session, at GMT0400, the pair is trading at 1.1107, with the EUR trading a tad higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1088, and a fall through could take it to the next support level of 1.1068. The pair is expected to find its first resistance at 1.1118, and a rise through could take it to the next resistance level of 1.1128.

Amid lack of macroeconomic news in Euro-zone today, traders will focus on the US Michigan consumer sentiment index for December along with nonfarm payrolls, average hourly earnings and unemployment rate all for November, slated to release later in the day.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.