For the 24 hours to 23:00 GMT, the EUR rose 0.13% against the USD and closed at 1.1160.

In economic news, the Euro-zone’s unemployment rate remained steady at a level of 10.1% in July, its lowest level since July 2011. Further, the region’s preliminary consumer price index (CPI) rose less-than-expected by 0.2% YoY in August, thus pressurising the European Central Bank to unleash additional monetary policy measures in order to revive economic growth in the Euro zone. Markets had expected the CPI to advance by 0.3%, following a 0.2% rise in the prior month. Meanwhile, Germany’s seasonally adjusted unemployment rate remained steady at a record low level of 6.1% in August, meeting market expectations. Additionally, the nation’s retail sales rebounded by 1.7% on a monthly basis in July, beating market expectations for a rise of 0.5% and following a revised drop of 0.6% in the previous month.

In the US, ADP’s private sector employment rose more-than-anticipated by 177.0K in August, indicating continuous strength in the nation’s labour market. The private sector employment had registered a revised gain of 194.0K in the prior month, compared to market anticipation of an advance of 175.0K. Moreover, the nation’s pending home sales climbed by 1.3% MoM in July, surpassing market expectations for a rise of 0.7%. In the prior month, pending home sales had registered a revised drop of 0.8%. Also, mortgage applications advanced by 2.8% during the week ended 26 August 2016, after recording a drop of 2.1% in the prior week. On the other hand, the Chicago Fed purchasing managers index fell more-than-anticipated to a level of 51.5 in August, compared to a reading of 55.8 in the prior month.

Separately, the Boston Federal Reserve (Fed) President, Eric Rosengren, stated that the central bank will probably meet its dual target of full employment and 2.0% inflation soon and warned that keeping interest rate low for too long could negatively impact the economy in the future.

In the Asian session, at GMT0300, the pair is trading at 1.1155, with the EUR trading marginally lower against the USD from yesterday’s close.

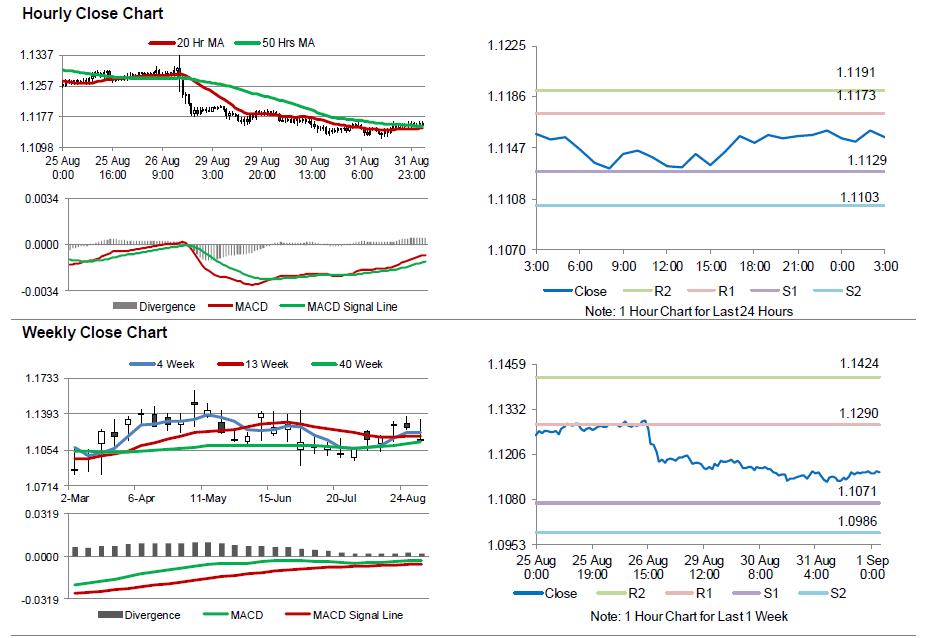

The pair is expected to find support at 1.1129, and a fall through could take it to the next support level of 1.1103. The pair is expected to find its first resistance at 1.1173, and a rise through could take it to the next resistance level of 1.1191.

Moving ahead, market participants would closely monitor final Markit manufacturing PMI across the Euro-zone for August, slated to release in a few hours. Moreover, the US ISM manufacturing, initial jobless claims, construction spending and final Markit manufacturing PMI data, all due to release later in the day, will attract a significant amount of investor attention.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.