For the 24 hours to 23:00 GMT, the EUR declined 0.64% against the USD and closed at 1.1243.

In economic news, the Euro-zone’s seasonally adjusted flash GDP expanded by 0.3% QoQ in Q4 2015, in line with market expectations and compared to a similar rise in the previous quarter, thus raising expectations for additional easing from the ECB in the near-term. Meanwhile, the region’s industrial production unexpectedly fell by 1.0% MoM in December, while markets expected it to rise by 0.3%, following a revised drop of 0.5% in the preceding month. . In other economic news, seasonally adjusted preliminary GDP data indicated that Germany’s economy grew 0.3% QoQ in the Q4 2015, at par with market consensus. Also, the nation’s final consumer price index fell as expected by 0.8% MoM in January, from a similar drop recorded in the preceding month.

In the US, advance retail sales rose for the third straight month, after it climbed by 0.2% in January, beating investor expectations for a rise of 0.1% and compared to a revised gain of 0.2% in the previous month. On the other hand, the nation’s preliminary Reuters/Michigan consumer sentiment index unexpectedly fell to a four-month low level of 90.7 in February, from a level of 92 in the previous month and compared to investor expectations for a rise to a level of 92.3. Also, US business inventories advanced less-than-anticipated by 0.1% in December, following a revised decline of 0.2% in the previous month.

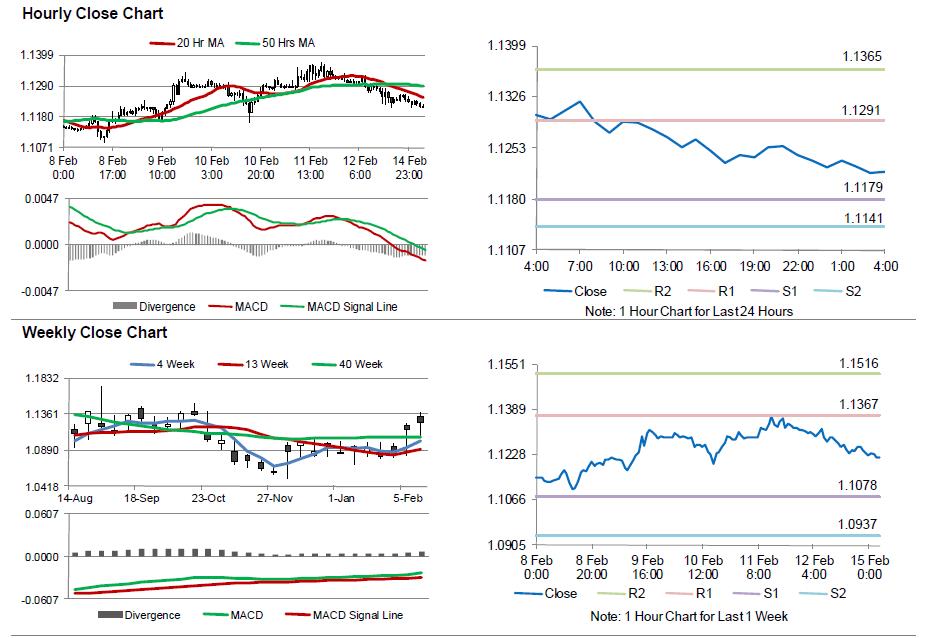

In the Asian session, at GMT0400, the pair is trading at 1.1218, with the EUR trading 0.22% lower from Friday’s close.

The pair is expected to find support at 1.1179, and a fall through could take it to the next support level of 1.1141. The pair is expected to find its first resistance at 1.1291, and a rise through could take it to the next resistance level of 1.1365.

Going ahead, Euro-zone’s trade balance data for December, scheduled to be released later today, will keep market participants on their toes. Additionally, the ECB President, Mario Draghi’s testimony on monetary policy before the European Parliament’s Economic and Monetary Affairs Committee, scheduled later today would keep investors on their toes.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.