For the 24 hours to 23:00 GMT, the EUR rose 0.12% against the USD and closed at 1.1022.

On the data front, Euro-zone’s seasonally adjusted second estimate of gross domestic product (GDP) rose 0.2% on a quarterly basis in 3Q 2019, compared to a similar rise in the previous quarter. The preliminary figures had indicated a rise of 0.2%.

Separately, in Germany, seasonally adjusted flash gross domestic product (GDP) unexpectedly advanced 0.1% on a quarterly basis in 3Q 2019, defying market expectations for a fall of 0.1%. In the prior quarter, GDP had recorded a drop of 0.1%.

In the US, data showed that the producer price index (PPI) climbed 1.1% on an annual basis in October, rising by the most in six months and beating market consensus for an advance of 0.9%. In the prior month, PPI had recorded a rise of 1.4%. Meanwhile, the number of Americans filling for fresh employment benefits advanced to a 5-month high level of 225.0K in the week ended 08 November 2019, higher than market anticipation for an increase to a level of 215.0K. Initial jobless claims had registered a reading of 211.0K in the prior week.

In the Asian session, at GMT0400, the pair is trading at 1.1025, with the EUR trading a tad higher against the USD from yesterday’s close.

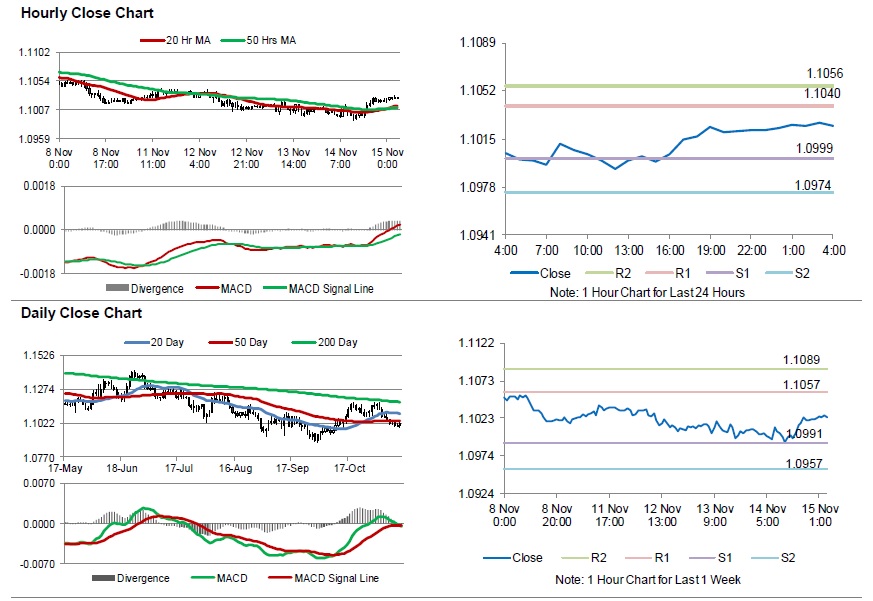

The pair is expected to find support at 1.0999, and a fall through could take it to the next support level of 1.0974. The pair is expected to find its first resistance at 1.1040, and a rise through could take it to the next resistance level of 1.1056.

Looking ahead, traders would await Euro-zone’s consumer price index for October and trade balance data for September, set to release in a few hours. Later in the day, the US advance retail sales and manufacturing (SIC) production, both for October along with the NY Empire State manufacturing index for November, will keep traders on their toes.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.