For the 24 hours to 23:00 GMT, the EUR rose 0.27% against the USD and closed at 1.1214, amid upbeat economic data.

On the data front, the Euro-zone’s seasonally adjusted flash gross domestic product (GDP) climbed 0.4% on a monthly annual basis in 1Q 2019, surpassing market consensus for a rise of 0.3%. In the prior quarter, the GDP had recorded a revised gain of 0.2%. Moreover, the region’s unemployment rate unexpectedly fell to a rate of 7.7% in March, declining to its lowest level since September 2008 and compared to 7.8% in the prior month. Market participants had anticipated the unemployment rate to remain unchanged.

Separately, in Germany, the preliminary consumer price index advanced 2.0% on a yearly basis in April, following a rise of 1.3% in the previous month. Market participants had envisaged the CPI to register a climb of 1.5%. Moreover, the nation’s seasonally adjusted unemployment rate remained unchanged at 4.9% in April, at par with market expectations. Also, the Gfk consumer confidence index remained steady at a level of 10.4 in May, defying market expectations for a fall to a level of 10.3.

In the US, data showed that the Chicago Fed purchasing managers’ index dropped to a level of 52.6 in April, compared to a reading of 58.7 in the previous month. Markets had expected the index to record a fall to a level of 58.5. Additionally, the nation’s pending home sales declined for the 15th straight month by 3.2% on an annual basis in March, following a decrease of 5.0% in the preceding month.

On the other hand, the US CB consumer confidence index rose to a level of 129.2 in April, surpassing market consensus for a gain to a level of 126.8. In the prior month, the index had recorded a revised level of 124.1.

In the Asian session, at GMT0300, the pair is trading at 1.1217, with the EUR trading slightly higher against the USD from yesterday’s close.

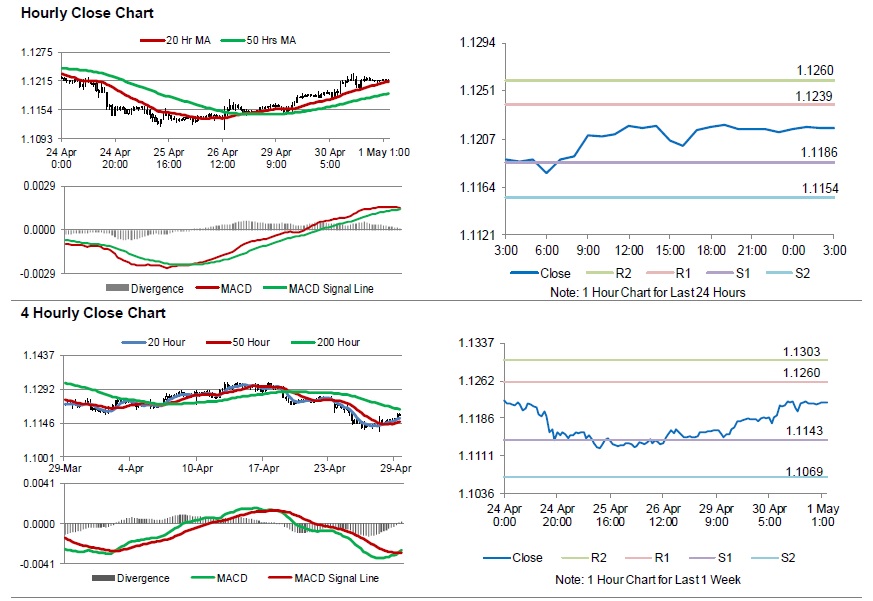

The pair is expected to find support at 1.1186, and a fall through could take it to the next support level of 1.1154. The pair is expected to find its first resistance at 1.1239, and a rise through could take it to the next resistance level of 1.1260.

Amid no major releases in the Euro-zone today, traders would keep an eye on the US Federal Reserve’s interest rate decision along with the US ADP employment change, the Markit manufacturing PMI and the ISM manufacturing index, all for April as well as the US construction spending data for March, set to release later in the day

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.