For the 24 hours to 23:00 GMT, the EUR declined 0.45% against the USD and closed at 1.1778, after the Euro-zone’s seasonally adjusted industrial production eased more-than-expected by 0.6% on a monthly basis in June, declining for the first time in four months. Industrial production had recorded a revised rise of 1.2% in the previous month, while markets had anticipated for a fall of 0.5%.

The greenback advanced against its key peers, as geopolitical concerns surrounding the US and North Korea ebbed.

The US Dollar added to gains, after the New York Federal Reserve (Fed) President, William Dudley, stated that he favours another interest rate hike before the year-end if the economy improves in line with expectations.

In the Asian session, at GMT0300, the pair is trading at 1.1783, with the EUR trading a tad higher against the USD from yesterday’s close.

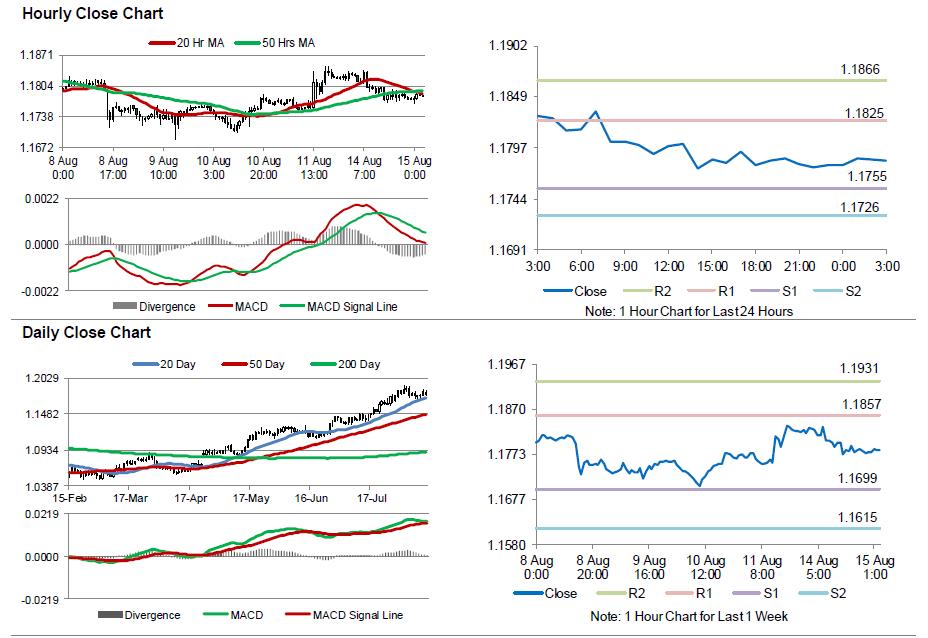

The pair is expected to find support at 1.1755, and a fall through could take it to the next support level of 1.1726. The pair is expected to find its first resistance at 1.1825, and a rise through could take it to the next resistance level of 1.1866.

Trading trend in the Euro today is expected to be determined by the release of Germany’s flash 2Q GDP data, scheduled in a few hours. Additionally, in the US, retail sales for July, NAHB housing market index for August and business inventories for June, all set to release later in the day, will pique significant amount of investor attention.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.