For the 24 hours to 23:00 GMT, the EUR slightly rose against the USD and closed at 1.1212.

On the macro front, the Euro-zone’s seasonally adjusted industrial production advanced for the second straight month, after it rose 0.5% on a monthly basis in April, meeting market expectations and following a revised gain of 0.2% in the previous month.

Separately, Germany’s final consumer price index (CPI) climbed 1.5% YoY in May, rising at its weakest pace in six months and confirming the flash estimate. The CPI had advanced 2.0% in the prior month.

The US Dollar clawed back some of its losses against a basket of currencies, after the Federal Reserve (Fed) raised interest rates for the second time this year and painted a rosier picture of the US economy.

The Fed, at its latest monetary policy meeting, raised its benchmark interest rate by a quarter percentage point to a target range of 1.00% to 1.25%, citing continued US economic growth and job market strength. Additionally, it indicated plans to pare back its $4.5 trillion balance sheet this year if the economy evolves as the central bank expects. In a post-meeting statement, the Fed judged that the recent weakness in economic data is temporary and maintained the outlook for one more rate hike this year but did not shed light on the timing of the rate hike.

Meanwhile, in its latest quarterly economic forecasts report, the central bank stuck to its outlook of three interest rate hikes in 2018. Moreover, policymakers slightly raised their economic growth forecast for this year to 2.1% but kept the estimates for 2018 and 2019 unchanged at 2.1% and 1.9% respectively. Inflation is expected to be at 1.7% by the end of this year, down from the 1.9% previously forecast.

Prior to the Fed interest rate decision, the greenback declined against its major peers, after the US inflation and retail sales data surprised with an unexpected drop.

The US CPI unexpectedly eased 0.1% on a monthly basis in May, suggesting that inflationary pressures in the world’s largest economy are moderating. The CPI had registered a rise of 0.2% in the prior month, while markets expected it to record a flat reading. Further, the nation’s advance retail sales surprisingly declined 0.3% MoM in May, defying market consensus for a flat reading. Advance retail sales had recorded a rise of 0.4% in the previous month. Further, the nation’s business inventories fell 0.2% in April, at par with market expectations. In the previous month, business inventories had advanced 0.2%.

In the Asian session, at GMT0300, the pair is trading at 1.1218, with the EUR trading marginally higher against the USD from yesterday’s close.

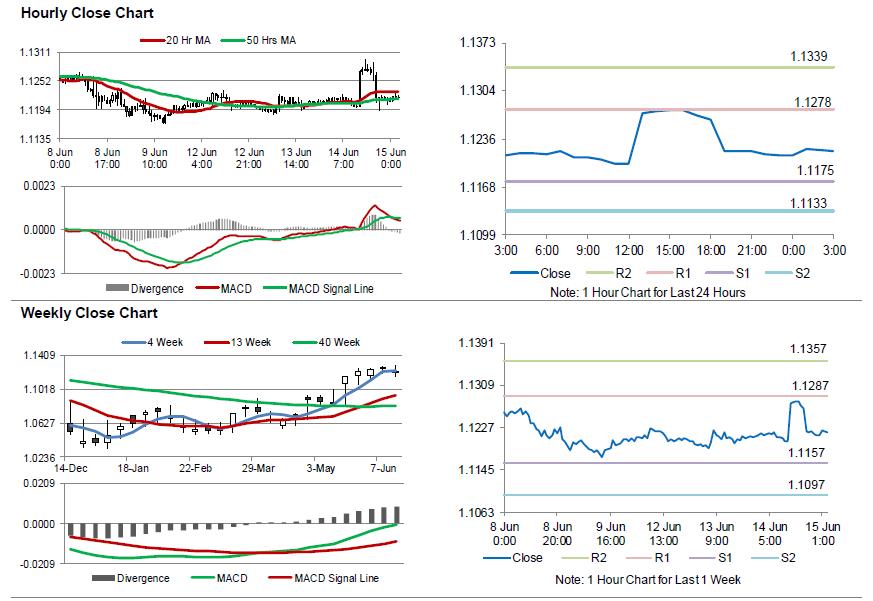

The pair is expected to find support at 1.1175, and a fall through could take it to the next support level of 1.1133. The pair is expected to find its first resistance at 1.1278, and a rise through could take it to the next resistance level of 1.1339.

Going ahead, market participants will keep a close watch on the Euro-zone’s trade balance for April, slated to release in a few hours. Moreover, the US initial jobless claims, industrial as well as manufacturing production for May and NAHB housing market index for June, set to release later in the day, will keep investors on their toes.

The currency pair is trading below its 20 Hr moving average and showing convergence with its 50 Hr moving average.