For the 24 hours to 23:00 GMT, the EUR declined 0.42% against the USD and closed at 1.1012.

In economic news, data indicated that Euro-zone’s seasonally adjusted industrial production rebounded by 1.6% on a monthly basis in August, more than market expectations for an advance of 1.5% and following a revised drop of 0.7% in the previous month.

The US Dollar gained ground against its key counterparts, after minutes from the US Federal Reserve’s September meeting showed that the central bank is moving closer to raising interest rates. The minutes highlighted internal divisions over the timing of the next rate move and revealed that some Fed officials judged an interest rate hike would be warranted “relatively soon” as the economy was strong enough to withstand a rate hike, while others wanted more evidence that inflation and labour market is firming before raising rates. Further, it showed that officials who favour hiking interest rates fretted over waiting too long as it could send the country into a recession.

Meanwhile, the policymakers also reduced their economic growth forecasts and slashed the expected path of interest rate hikes to one hike this year, two in 2017 and three each in 2018 and 2019.

In other economic news, the nation’s JOLTs job openings dropped to a level of 5443.0K in August, after recording a revised reading of 5831.0K in the prior month. Also, the nation’s mortgage applications eased by 6.0% during the week ended 07 October 2016, following a rise of 2.9% in the previous week.

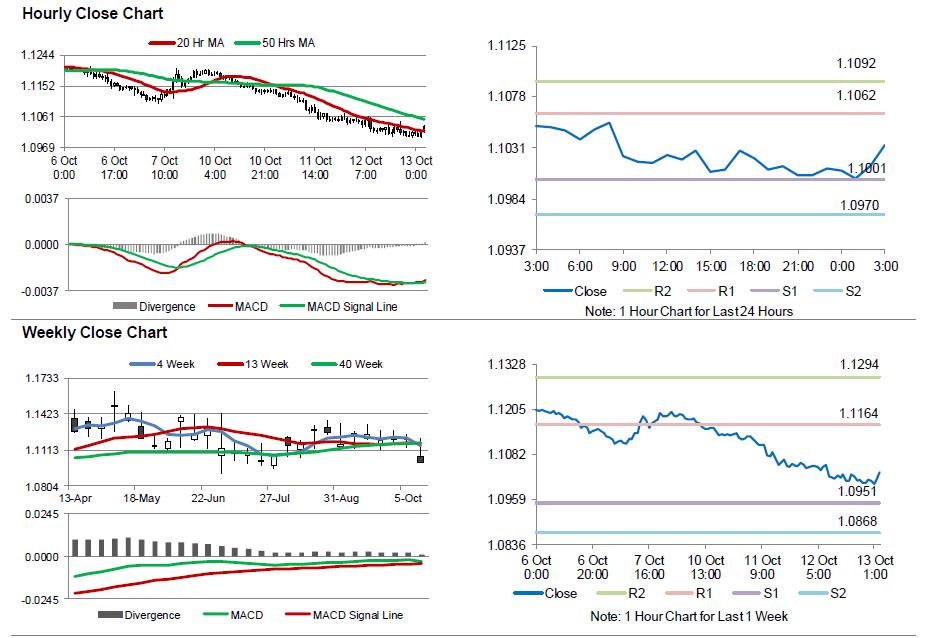

In the Asian session, at GMT0300, the pair is trading at 1.1033, with the EUR trading 0.19% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1001, and a fall through could take it to the next support level of 1.0970. The pair is expected to find its first resistance at 1.1062, and a rise through could take it to the next resistance level of 1.1092.

Looking ahead, market participants would await the release of Germany’s final consumer price index for September, due to release in a few hours. Moreover, the US initial jobless claims data, slated to release later in the day, would garner a lot of market attention.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.