For the 24 hours to 23:00 GMT, the EUR declined 0.30% against the USD and closed at 1.0817.

On the macro front, Euro-zone’s seasonally adjusted industrial production slumped 11.3% on a monthly basis in March, less than market forecast for a drop of 12.1% and compared to a fall of 0.1% in the previous month.

In the US, the producer price index dropped 1.3% on a monthly basis in April, recording its largest decrease since 2009 and more than expectations for a drop of 0.5%. In the previous month, the index had recorded a drop of 0.2%. Meanwhile, the MBA mortgage applications rose 0.3% on a weekly basis in the week ended 8 May 2020, compared to a rise of 0.1% in the previous week.

Separately, the US Federal Reserve Chairman, Jerome Powell, in his speech, warned that the coronavirus crisis could result in a “prolonged recession and weak recovery” thereby causing a lasting damage. Powell also warned of “significant downside risks” to the economic outlook. Moreover, he stated that the central bank may take additional steps to boost economic recovery but it does not favour using negative interest rates as a policy tool.

In the Asian session, at GMT0300, the pair is trading at 1.0814, with the EUR trading marginally lower against the USD from yesterday’s close.

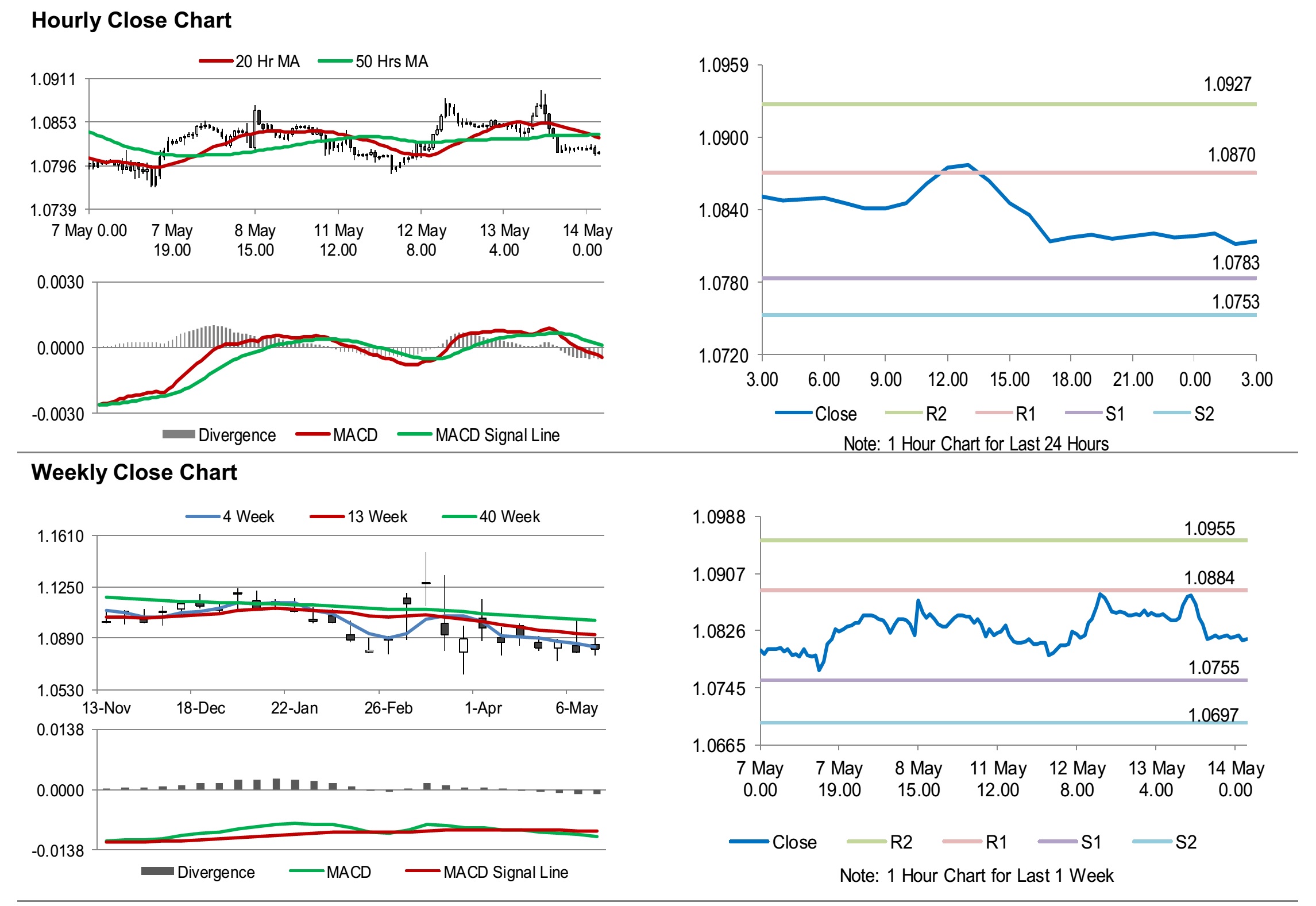

The pair is expected to find support at 1.0783, and a fall through could take it to the next support level of 1.0753. The pair is expected to find its first resistance at 1.0870, and a rise through could take it to the next resistance level of 1.0927.

Looking forward, traders would keep a watch on Germany’s consumer price index for April, slated to release in a few hours. Later in the day, the US initial jobless claims would keep investors on their toes.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.