For the 24 hours to 23:00 GMT, the EUR rose 0.29% against the USD and closed at 1.1001, after the Euro-zone’s consumer price index (CPI) accelerated 0.4% MoM in September, in line with market expectations and hitting its two-year high level, thus indicating that massive measures taken by the European Central Bank to shore up economy are showing effects. In the prior month, the CPI had advanced by 0.1%.

Macroeconomic data released in the US indicated that industrial production rebounded by 0.1% on a monthly basis in September, in line with market expectations and following a revised drop of 0.5% in the previous month. Additionally, the nation’s manufacturing production advanced more-than-expected by 0.2% MoM in September, compared to market expectations for a rise of 0.1% and after recording a revised fall of 0.5% in the prior month.

Separately, the Federal Reserve (Fed) Vice Chairman, Stanley Fischer, warned that the US economy may face longer and deeper recession in the future if interest rates remain stuck at current low levels. Further he noted that the Fed is “very future close” to its full employment and inflation target.

In the Asian session, at GMT0300, the pair is trading at 1.1016, with the EUR trading 0.14% higher against the USD from yesterday’s close.

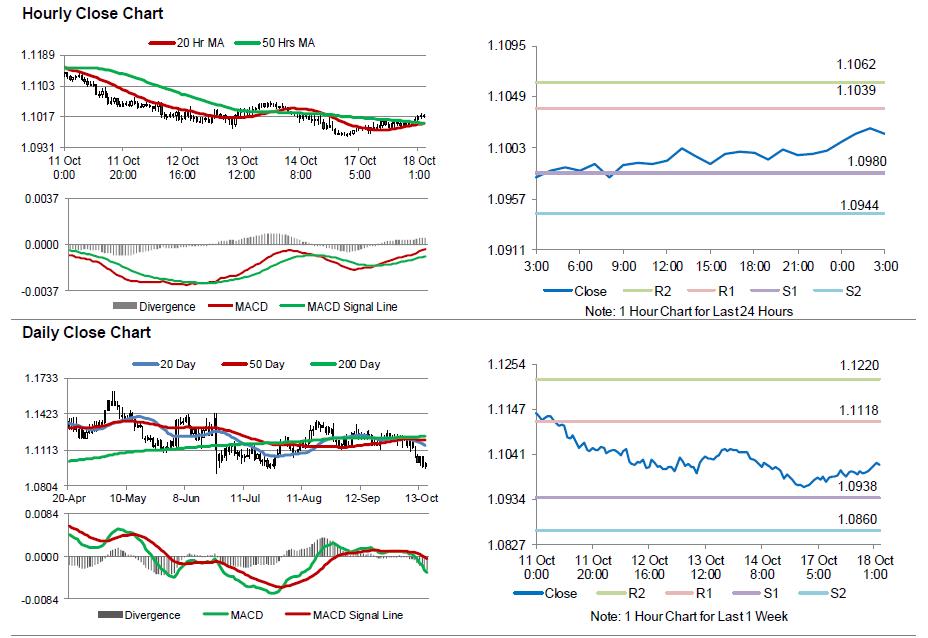

The pair is expected to find support at 1.0980, and a fall through could take it to the next support level of 1.0944. The pair is expected to find its first resistance at 1.1039, and a rise through could take it to the next resistance level of 1.1062.

With no major economic releases in the Euro-zone today, investors would look forward to the US consumer price inflation for September and NAHB housing market index for October, slated to release later in the day.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.