For the 24 hours to 23:00 GMT, the EUR declined 0.60% against the USD and closed at 1.0993 on Friday.

On the data front, Euro-zone’s preliminary consumer price index (CPI) rose 1.0% on an annual basis in August, in line with market expectations. In the prior month, the CPI had recorded a similar gain. Meanwhile, the region’s unemployment rate remained steady at 7.5% in July, meeting market expectations.

Separately, in Germany, the retail sales dropped 2.2% on a monthly basis in July, compared to a revised advance of 3.0% in the previous month. Market participants had anticipated retail sales to register a drop of 1.3%.

In the US, data showed that the Chicago Fed Purchasing Managers’ Index climbed to a level of 50.4 in August, higher than market expectation for a rise to a level of 47.5. In the preceding month, the index had recorded a reading of 44.4. Further, the personal spending climbed 0.6% on a monthly basis in July, surpassing market consensus for an advance of 0.5%. Personal spending had recorded a rise of 0.3% in the previous month. Meanwhile, the nation’s personal income advanced 0.1% on a monthly basis in July, less than market expectations for a gain of 0.3%. In the prior month, personal income had registered a revised rise of 0.5%. Additionally, the US final Reuters/Michigan consumer sentiment index fell to a level of 89.8 in August, declining to its lowest level in 6-years and more than market consensus for a fall to a level of 92.4. In the prior month, the index had recorded a level of 98.4, while preliminary figures had indicated a drop to a level of 92.1.

In the Asian session, at GMT0300, the pair is trading at 1.0992, with the EUR trading a tad lower against the USD from Friday’s close.

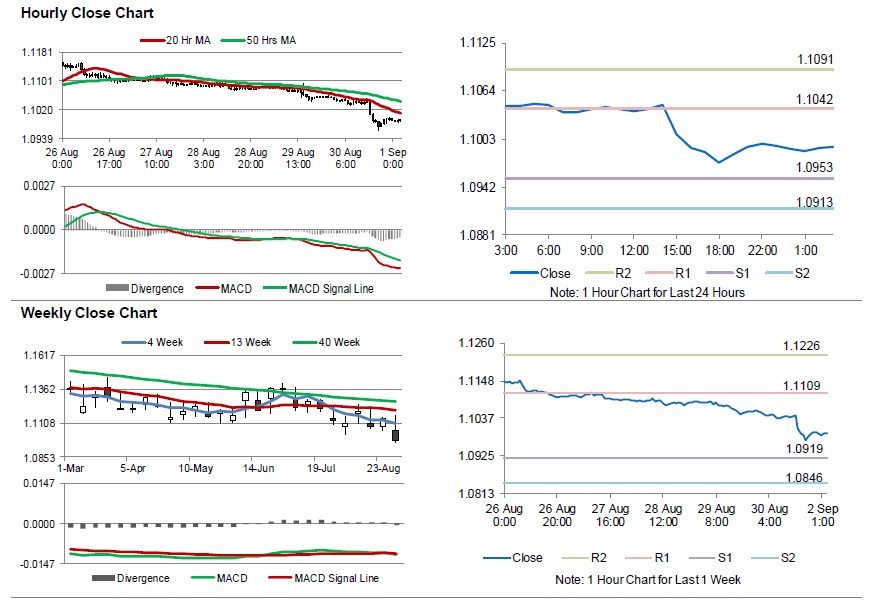

The pair is expected to find support at 1.0953, and a fall through could take it to the next support level of 1.0913. The pair is expected to find its first resistance at 1.1042, and a rise through could take it to the next resistance level of 1.1091.

Amid no major economic news in the US today, investors would keep an eye on the Markit manufacturing PMI for August, slated to release across the euro bloc.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.