For the 24 hours to 23:00 GMT, the EUR rose marginally against the USD and closed at 1.1020.

In economic news, the Euro-zone’s consumer price index fell by 1.4% MoM in January, in line with market expectations, after recording a flat reading in the previous month, thus further consolidating expectations that the ECB will come up with more stimulus next month to shore up slowing economic growth. Meanwhile, the region’s final estimate of annual inflation rose 0.3% in January, lower than initial estimate of 0.4% inflation.

Elsewhere, in Germany, the Gfk consumer confidence unexpectedly rose to a level of 9.5 in March, indicating that private consumption will continue to drive growth in Europe’s largest economy. The index had registered a level of 9.4 in the prior month while markets expected it to ease to a level of 9.3.

In the US, flash durable goods orders rebounded by 4.9% in January, marking its biggest gain in ten-months and beating market expectations for a rise of 2.9%, from a revised drop of 4.6% in the preceding month, thus pointing towards recovery in the nation’s manufacturing industry after struggling for the past year constrained by a strong dollar, weak global demand and declining oil prices.

On the other hand, the nation’s initial jobless claims advanced more-than-expected to a level of 272.0K in the week ended 20 February, compared to market expectations for a rise to a level of 270.0K, after registering a reading of 262.0K in the previous week. Additionally, the nation’s housing price index unexpectedly fell to 0.4% MoM in December whereas markets expected for an advance of 0.5%, at par with previous month’s reading.

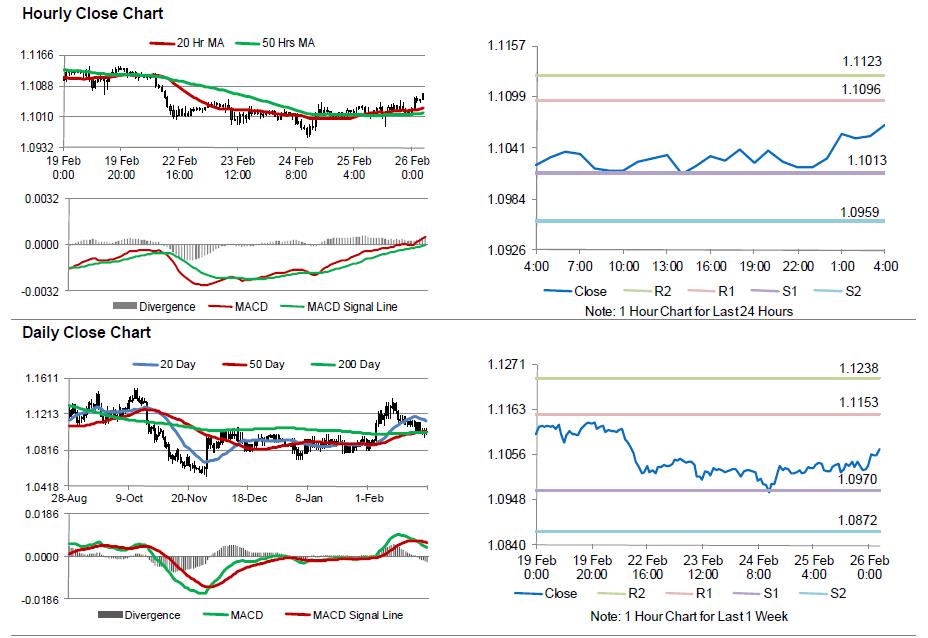

In the Asian session, at GMT0400, the pair is trading at 1.1068, with the EUR trading 0.44% higher from yesterday’s close.

The pair is expected to find support at 1.1013, and a fall through could take it to the next support level of 1.0959. The pair is expected to find its first resistance at 1.1096, and a rise through could take it to the next resistance level of 1.1123.

Looking ahead, investor sentiment would be governed by the release of the Eurozone’s consumer confidence and Germany’s consumer price indices data, slated to be released later today. Additionally, US preliminary Q4 GDP data, scheduled to be released later in the day, will also attract a lot of market attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.