For the 24 hours to 23:00 GMT, the EUR rose 0.58% against the USD and closed at 1.1440 on Friday.

Macroeconomic data showed that Euro-zone’s final consumer price index (CPI) rose as initially estimated to 2.1% on annual basis in July, at par with market expectations and recording its highest level since late 2012. In the previous month, the CPI had risen 2.0%. Moreover, the region’s seasonally adjusted current account surplus recorded a steady reading of €24.0 billion in June.

In the US, data indicated that the preliminary Reuters/Michigan consumer sentiment index unexpectedly eased to a level of 95.3 in August, marking its lowest level in 11-months, amid slowdown in the household purchasing power. The index had registered a reading of 97.9 in the preceding month while market participants had anticipated the index to advance to a level of 98.0. Meanwhile, the leading indicator increased 0.6% on monthly basis in July, higher than market consensus for a rise of 0.4%. Leading indicator had climbed 0.5% in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.1428, with the EUR trading 0.10% lower against the USD from Friday’s close.

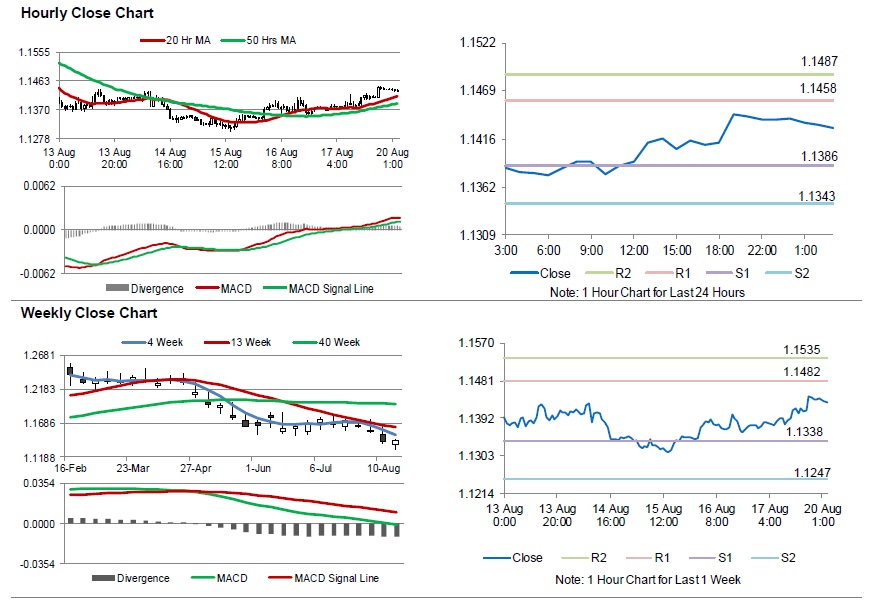

The pair is expected to find support at 1.1386, and a fall through could take it to the next support level of 1.1343. The pair is expected to find its first resistance at 1.1458, and a rise through could take it to the next resistance level of 1.1487.

Moving ahead, investors would await Euro-zone’s construction output for June, along with Germany’s producer price index for July, set to release in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.