For the 24 hours to 23:00 GMT, the EUR rose 0.38% against the USD and closed at 1.1075.

On the macro front, Euro-zone’s final consumer price inflation slowed to a 3-year low level of 0.8% on an annual basis in September, amid decline in energy prices and compared to a level of 1.0% in the previous month. Meanwhile, the region’s seasonally adjusted trade surplus widened more-than-expected to €20.3 billion in August, compared to a revised surplus of €17.5 billion in the previous month. Market participants had envisaged the nation to register a surplus of €18.9 billion.

Separately, the US dollar declined against its major peers, amid dismal US retail sales data.

In the US, data showed that advance retail sales declined for the first time in seven months by 0.3% on a monthly basis in September, following a revised rise of 0.6% in the prior month. On the other hand, the nation’s NAHB housing market index unexpectedly rose to a 20-month high level of 71.0 in October, defying market expectations for an unchanged reading. The index had registered a reading of 68.0 in the prior month. Moreover, the MBA mortgage applications advanced 0.5% on a weekly basis in the week ended 11 October 2019, compared to a rise of 5.4% in the previous week.

The US Federal Reserve, in its latest Beige Book, revealed that the US economy witnessed only “slight to moderate” expansion through mid-September, amid ongoing US-China trade war. Household spending was strong and tourism and travel-related spending rose modestly, but warned that manufacturing activity continued to edge lower due to persistent trade tensions and slower global growth. On the outlook front, the Beige Book stated although business contacts expect to observe further expansion but have reduced their growth forecasts for the coming year.

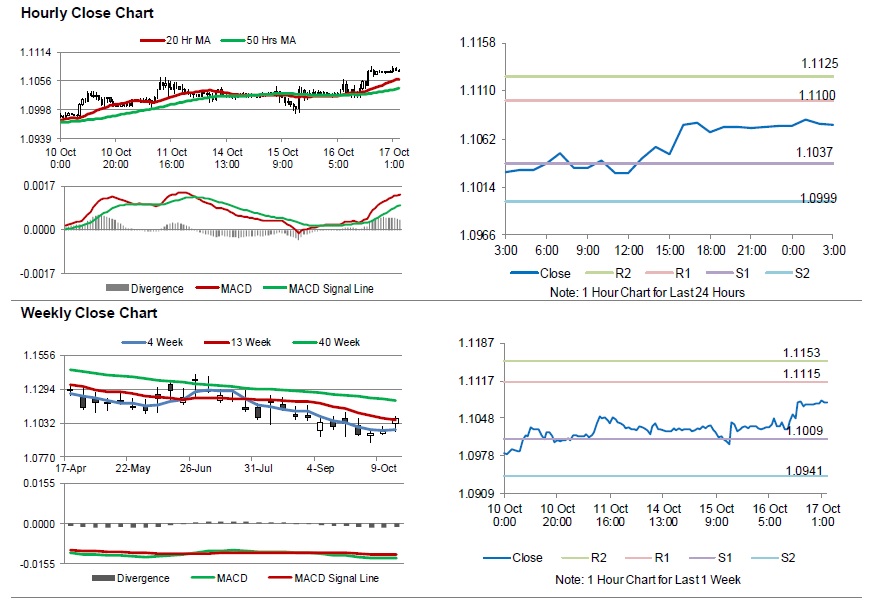

In the Asian session, at GMT0300, the pair is trading at 1.1076, with the EUR trading marginally higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1037, and a fall through could take it to the next support level of 1.0999. The pair is expected to find its first resistance at 1.1100, and a rise through could take it to the next resistance level of 1.1125.

Going ahead, traders would keep an eye on Euro-zone’s construction output for August, set to release in a few hours. Later in the day, the US Philadelphia Fed Manufacturing Index for October, along with building permits, housing starts and industrial production, all for September will be on investors’ radar. Also, the US initial jobless claims would garner significant amount of investors’ attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.