For the 24 hours to 23:00 GMT, the EUR slightly rose against the USD and closed at 1.1399 on Friday.

Data indicated that the Euro-zone’s flash consumer price inflation slowed more than expected to 1.6% on a yearly basis in December, recording its lowest level in eight months, amid weakness in energy prices. The CPI had recorded a gain of 1.9% in the previous month. Moreover, the region’s producer price index (PPI) climbed 4.0% on an annual basis in November, falling short of market expectations for an advance of 4.2%. The PPI had registered an increase of 4.9% in the preceding month. On the flipside, the nation’s final services PMI declined more than anticipated to a 4-year low level of 51.2 in December, diminishing the possibilities for further near-term interest rate hike. Preliminary figures had indicated for a fall to a level of 51.4. In the preceding month, the PMI had registered a reading of 53.4. Separately, in Germany, the final services PMI eased to a 27-month low level of 51.8 in December, compared to market expectations for a drop to a level of 52.5. In the previous month, the PMI had registered a level of 53.3. Meanwhile, the nation’s seasonally adjusted unemployment rate remained unchanged at 5.0% in December, marking its record low level since German reunification in 1990 and meeting market expectations.

In the US, data showed that the US final Markit services PMI eased to a level of 54.4 in December, more than market expectations. The PMI had recorded a reading of 54.7 in the previous month. The preliminary figures had indicated a drop to 53.40. Furthermore, the nation’s unemployment rate in unexpectedly advanced to a 10-mont high level of 3.9% in December, compared to market consensus for an unchanged reading. In the prior month, unemployment rate had registered a reading of 3.7%.

On the contrary, the US non-farm payrolls sharply rose to its highest level in 11-months by 312.0K in December, surpassing market expectations of a gain of 184.0K. Non-farm payrolls had recorded a revised rise of 176.0K in the previous month. Additionally, average hourly earnings of all employees jumped 3.2% on an annual basis in December, following a rise of 3.1% in the previous month. Market participants had envisaged average hourly earnings to record a climb of 3.0%.

In the Asian session, at GMT0400, the pair is trading at 1.1424, with the EUR trading 0.22% higher against the USD from Friday’s close, after the US Fed Chairman, Jerome Powell stated that the Fed would put its policy tightening on pause in 2019.

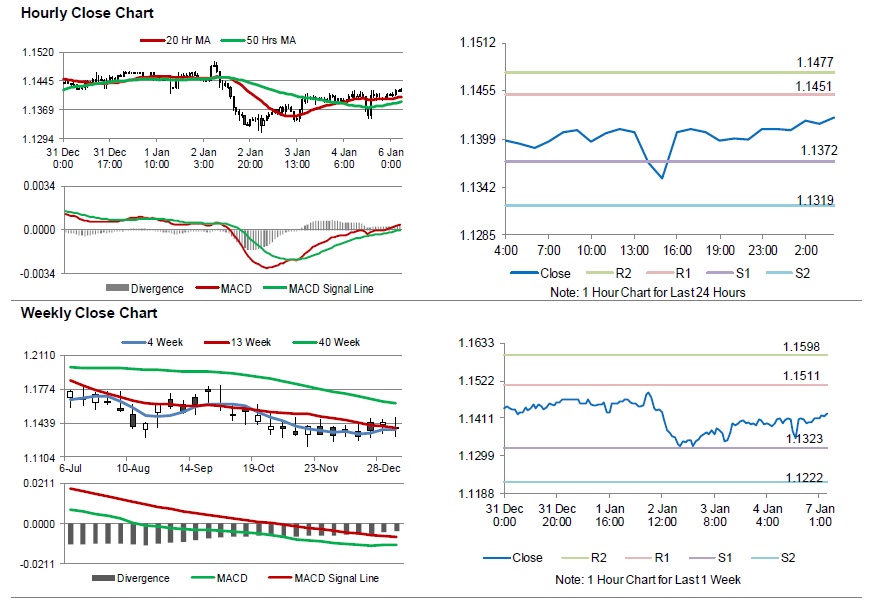

The pair is expected to find support at 1.1372, and a fall through could take it to the next support level of 1.1319. The pair is expected to find its first resistance at 1.1451, and a rise through could take it to the next resistance level of 1.1477.

Looking ahead, investors would await the Euro-zone’s Sentix investor confidence for January and retail sales for November along with Germany’s retail sales and factory orders, both for November, set to release in a few hours. Later in the day, the US ISM non-manufacturing PMI for December, will be on investors’ radar.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.