For the 24 hours to 23:00 GMT, the EUR rose 0.9% against the USD and closed at 1.0795, after the Euro-zone’s flash consumer price index (CPI) jumped more-than-expected by 1.8% on an annual basis in January, surging to its highest level in nearly four-years, a development that is likely to amplify calls for the European Central Bank to reconsider its monetary policy stance. Meanwhile, the CPI registered a rise of 1.1% in the previous month, while markets were anticipating for an advance of 1.5%. Additionally, the region’s seasonally adjusted preliminary gross domestic product (GDP) showed that the economy expanded 0.5% QoQ in the fourth quarter, meeting market expectations and following a revised rise of 0.4% in the previous month. Further, the region’s unemployment rate surprisingly plummeted to a seven-year low level of 9.6% in December, highlighting that the labour market is gaining strong momentum. In the previous month, the unemployment rate had registered a revised level of 9.7%, whereas investors had envisaged for an increase to 9.8%.

Separately, Germany’s seasonally adjusted unemployment rate unexpectedly declined to a record low level of 5.9% in January, whereas investors were expecting the unemployment rate to remain steady at 6.0%. Moreover, the nation’s retail sales unexpectedly eased 0.9% on a monthly basis in December, defying market expectations for an advance of 0.6%. In the previous month, retail sales had dropped by a revised 1.7%.

The greenback lost ground against its key counterparts, after the US CB consumer confidence index dropped to a level of 111.8 in January, surpassing market anticipation for the index to ease to a level of 112.8 and compared to a revised level of 113.3 in the previous month. Also, the nation’s Chicago Fed purchasing managers index unexpectedly fell to a level of 50.3 in January, hitting its lowest level since May 2016 and confounding market expectation for a rise to a level of 55.0. In the previous month, the index recorded a revised level of 53.9 in the prior month.

In the Asian session, at GMT0400, the pair is trading at 1.0792, with the EUR trading marginally lower against the USD from yesterday’s close.

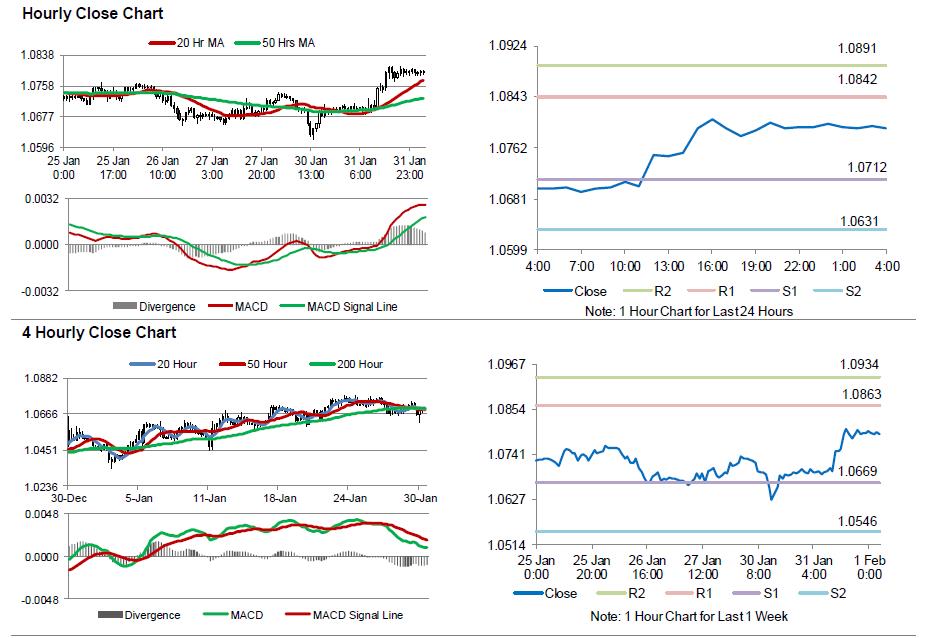

The pair is expected to find support at 1.0712, and a fall through could take it to the next support level of 1.0631. The pair is expected to find its first resistance at 1.0842, and a rise through could take it to the next resistance level of 1.0891.

Ahead in the day, investors will closely monitor the release of final Markit manufacturing PMI for January across the Euro-zone and the European Commission’s economic growth forecast report. Also, the US ADP employment change, ISM manufacturing and final Markit manufacturing PMI, all for January, along with construction spending for December, scheduled to release later in the day, will keep investors on their toes.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.