For the 24 hours to 23:00 GMT, the EUR rose 0.07% against the USD and closed at 1.0433, as the European Central Bank (ECB) struck a hawkish tone in its latest economic bulletin report.

The ECB indicated that, it still expects inflation in the common currency region to rise significantly in the first quarter of 2017 and will exceed 1.0%. Furthermore, it forecasted that global growth is set to accelerate in the next year. However, the central bank warned that policy uncertainty in the US due to Donald Trump’s victory in the Presidential election and unstable commodity prices may still place pressure on the global economic recovery.

Separately, Germany’s annual import prices rebounded 0.3% in November, increasing for the first time in four years, compared to a drop of 0.6% in the previous month.

In the US, final reading of annualised gross domestic product (GDP) marked its strongest performance in two years, after it was revised up to 3.5% on a quarterly basis in the third quarter, buoyed by stronger consumer spending, while beating market expectations for an advance of 3.3%. The preliminary figures had indicated a rise of 3.2%, compared to an expansion of 1.4% in the prior quarter. Also, the nation’s personal spending advanced 0.2% in November, falling short of market expectations for a rise of 0.3% and after recording a revised rise of 0.4% in the prior month. Additionally, the nation’s housing price index increased less-than-anticipated by 0.4% in October. In the previous month, the housing price index had advanced 0.6%. On the other hand, the nation’s flash durable goods orders dropped less-than-expected by 4.6% MoM in November, dragged by a drop in commercial aircraft, declining for the first time in five months. Durable goods orders registered a revised gain of 4.6% in the prior month, compared to market expectations for a fall of 4.8%. Moreover, the number of Americans filing for fresh jobless claims climbed to a six month high level of 275.0K in the week ended 17 December 2016, after recording a reading of 254.0K in the prior week. Also, the nation’s personal income remained flat on a monthly basis in November, defying market consensus for an advance of 0.3%. In the previous month, personal income had climbed by a revised 0.5%. Further, the CB leading indicator surprisingly remained flat in November, compared to an advance of 0.1% in the prior month, whereas the Chicago Fed national activity index fell to a level of -0.27 in November, after recording a revised drop of 0.05 in the previous month.

In the Asian session, at GMT0400, the pair is trading at 1.0444, with the EUR trading 0.11% higher against the USD from yesterday’s close.

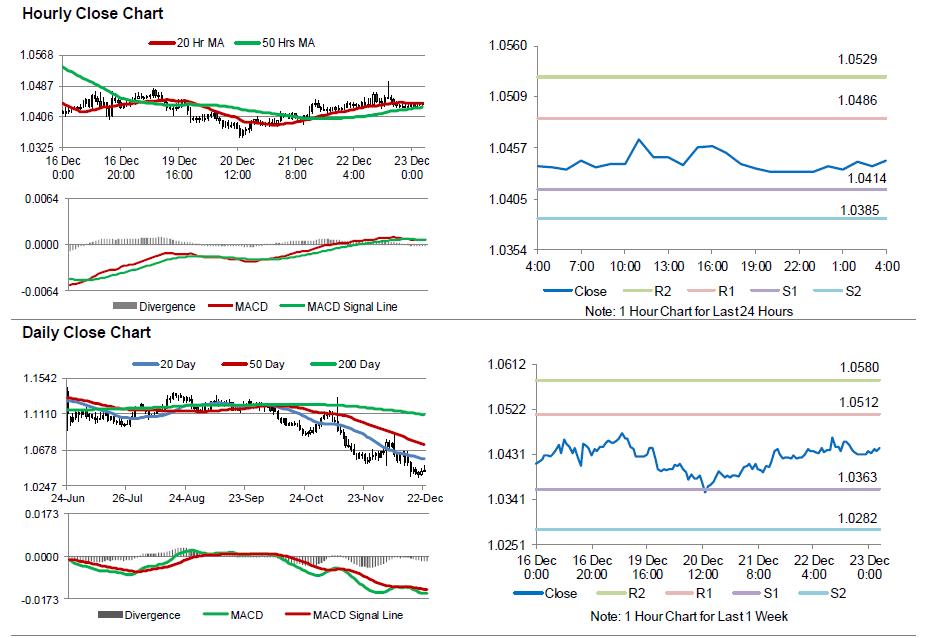

The pair is expected to find support at 1.0414, and a fall through could take it to the next support level of 1.0385. The pair is expected to find its first resistance at 1.0486, and a rise through could take it to the next resistance level of 1.0529.

Moving ahead, investors will look forward to Germany’s GfK consumer confidence index for January, slated to release in some time. Additionally, the US final Michigan consumer confidence index for December and new home sales for November, both scheduled to release later today, will keep investors on their toes.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.