For the 24 hours to 23:00 GMT, the EUR rose 0.12% against the USD and closed at 1.1896, after the Euro-zone’s Sentix investor confidence index surprisingly advanced to a level of 28.2 in September, confounding market expectations for a fall to a level of 27.0, suggesting that investors brushed-off recent strength in the Euro and acknowledged the economic rebound in the common currency region. The index had recorded a level of 27.7 in the prior month.

Meanwhile, the region’s producer price index (PPI) grew less-than-expected by 2.0% YoY in July, compared to a revised rise of 2.4% in the prior month.

In the Asian session, at GMT0300, the pair is trading at 1.1906, with the EUR trading 0.08% higher against the USD from yesterday’s close.

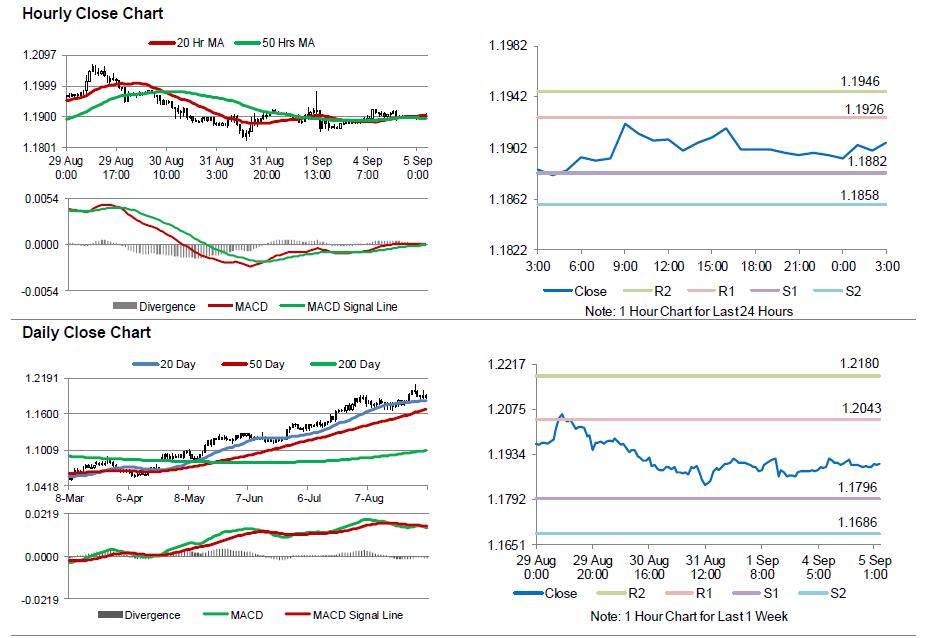

The pair is expected to find support at 1.1882, and a fall through could take it to the next support level of 1.1858. The pair is expected to find its first resistance at 1.1926, and a rise through could take it to the next resistance level of 1.1946.

Going ahead, investors will look forward to the final Markit services PMIs for August across the Euro-zone along with the region’s retail sales data for July, scheduled to release in a few hours. Additionally, in the US, final durable goods orders and factory orders, both for July, scheduled to release later today, will be on investors’ radar.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.