For the 24 hours to 23:00 GMT, the EUR rose 0.12% against the USD and closed at 1.1427.

On the macro front, the Euro-zone’s M3 money supply climbed 4.1% on a yearly basis in December, higher than market consensus for a rise of 3.8%. In the prior month, M3 money supply had recorded a gain of 3.7%.

Yesterday, the European Central Bank President, Mario Draghi expressed concerns over ongoing trade turmoil and geopolitical issues leading to a slowdown in the region’s economic growth.

In the US, data indicated that the Chicago Fed national activity index advanced to a level of 0.27 in December, amid upbeat manufacturing production and robust hiring. In the previous month, the index had registered a level of 0.21. Moreover, the nation’s Dallas Fed manufacturing business index rose to a level of 1.0 in January, compared to a reading of -5.1 in the prior month. Market participants had envisaged the index to record a gain to a level of -2.1.

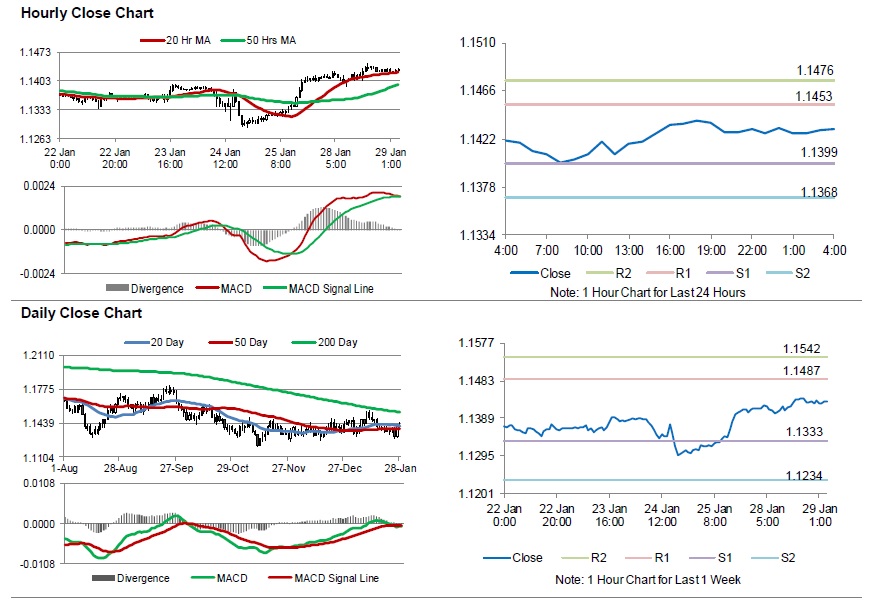

In the Asian session, at GMT0400, the pair is trading at 1.1431, with the EUR trading slightly higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1399, and a fall through could take it to the next support level of 1.1368. The pair is expected to find its first resistance at 1.1453, and a rise through could take it to the next resistance level of 1.1476.

Amid lack of economic releases in the Euro-zone today, traders would focus on the US consumer confidence index for January and S&P/Case-Shiller home price index for November, slated to release later in the day.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.