For the 24 hours to 23:00 GMT, the EUR rose 0.17% against the USD and closed at 1.1099.

In economic news, Euro-zone’s M3 money supply advanced 5.5% on an annual basis in September, lower than market consensus for a rise of 5.7%. In the previous month, M3 money supply had recorded a revised increase of 5.8%.

Separately, outgoing European Central Bank President, Mario Draghi, in his last speech, stated that Europe must take a leap forward in integration and create the institutions needed for economic stabilization as monetary policy loses potency. He suggested that a common budget for the EU was necessary so there would be a centralized capacity to stabilize the monetary union.

In the US, data showed that the Chicago Fed National Activity Index fell to a level of -0.5 in September, higher than market anticipations for a decline to a level of -0.4. The index had recorded a revised level of 0.2 in the prior month. Moreover, the nation’s Dallas Fed manufacturing business index dropped to a level of -5.1 in October, compared to market expectations for a fall to a level of 1.4. The index had recorded a reading of 1.5 in the previous month. Meanwhile, the US advance goods trade deficit narrowed to $70.39 billion in September, following a revised deficit of $73.06 billion in the prior month.

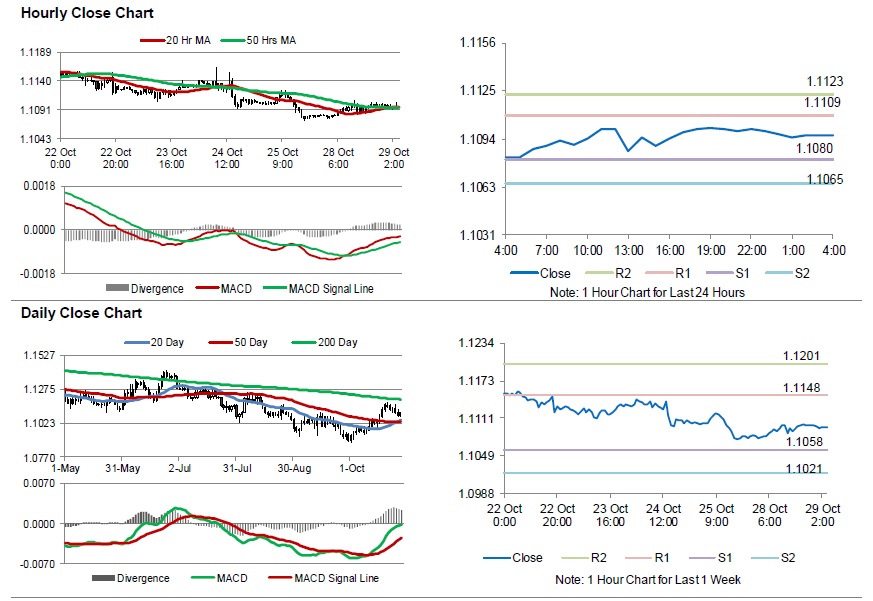

In the Asian session, at GMT0400, the pair is trading at 1.1096, with the EUR trading slightly lower against the USD from yesterday’s close.

The pair is expected to find support at 1.1080, and a fall through could take it to the next support level of 1.1065. The pair is expected to find its first resistance at 1.1109, and a rise through could take it to the next resistance level of 1.1123.

Amid lack of macroeconomic releases in the Euro-zone today, traders would keep an eye on the US pending home sales for September and the CB consumer confidence index for October, set to release later in the day.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.