For the 24 hours to 23:00 GMT, the EUR declined 0.07% against the USD and closed at 1.1084.

On the macro front, Euro-zone’s M3 money supply advanced 5.2% on a yearly basis in August, compared to a gain of 4.5% in the prior month. Market participants had envisaged M3 money supply to record a rise of 4.7%.

Separately, in Germany, the Gfk consumer confidence index remained unchanged at 9.7 in September, defying market consensus for a fall to a level of 9.6.

In the US, data showed that the MBA mortgage applications declined 6.2% on a weekly basis in the week ended 23 August 2019, following a drop of 0.9% in the prior month.

In the Asian session, at GMT0300, the pair is trading at 1.1082, with the EUR trading slightly lower against the USD from yesterday’s close.

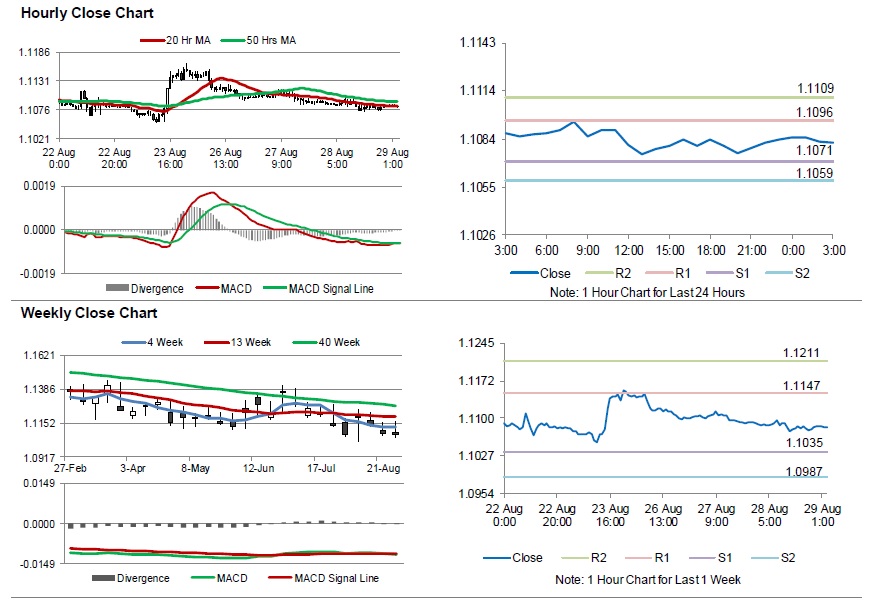

The pair is expected to find support at 1.1071, and a fall through could take it to the next support level of 1.1059. The pair is expected to find its first resistance at 1.1096, and a rise through could take it to the next resistance level of 1.1109.

Moving ahead, traders would closely monitor Euro-zone’s economic confidence, industrial confidence, business climate indicator and consumer confidence, all for August along with Germany’s consumer price index for August, set to release in a few hours. Later in the day, the US annualised gross domestic product for the second quarter 2019, advance goods trade balance and pending home sales, both for July followed by the initial jobless claims, will garner significant amount of investors’ attention.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.