For the 24 hours to 23:00 GMT, the EUR declined 0.27% against the USD and closed at 1.0920.

On the data front, Euro-zone’s M3 money supply climbed 5.7% on an annual basis in August, higher than market consensus for an advance of 5.1%. In the prior month, M3 money supply had recorded a rise of 5.2%.

Separately, in Germany, the GfK consumer confidence index unexpectedly rose to a level of 9.9 in October, defying market anticipations for a steady reading. In the preceding month, the index had registered a reading of 9.7.

In the US, data showed that the final annualised gross domestic product (GDP) advanced 2.0% on a quarterly basis in 2Q 2019, confirming the preliminary print. In the previous quarter, the annualised GDP had recorded a climb of 3.1%. Moreover, the nation’s advance goods trade deficit widened to $72.83 billion in August, compared to a revised deficit of $72.46 billion in the prior month. Additionally, the seasonally adjusted initial jobless claims climbed to a 3-week high level of 213.0K on a weekly basis in the week ended 20 September 2019, more than market expectation was for rise to a level of 212.0K. In the preceding month, initial jobless claims had registered a revised reading of 210.0K. Meanwhile, pending home sales rose more-than-expected by 1.6% on a monthly basis in August, following a decline of 2.5% in the previous month. Market participants had envisaged pending home sales to record a rise of 0.3%.

In the Asian session, at GMT0300, the pair is trading at 1.0920, with the EUR trading flat against the USD from yesterday’s close.

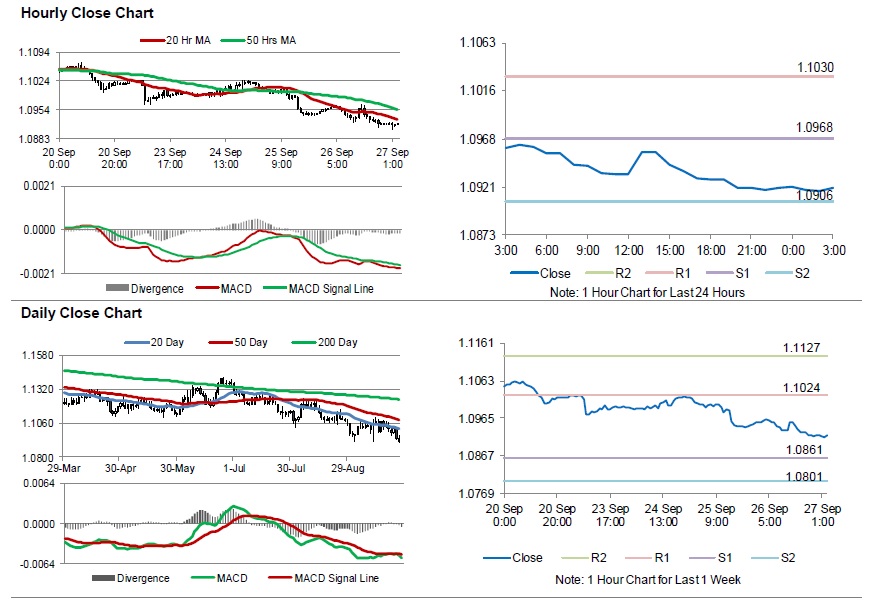

The pair is expected to find support at 1.0968, and a fall through could take it to the next support level of 1.0906. The pair is expected to find its first resistance at 1.1030, and a rise through could take it to the next resistance level of 1.1030.

Looking ahead, traders would await Euro-zone’s business confidence, economic sentiment and consumer confidence index, all for September, set to release in a few hours. Later in the day, the US durable goods orders, personal income and personal spending, all for August, along with the Michigan consumer sentiment index September, will keep traders on their toes.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.