For the 24 hours to 23:00 GMT, the EUR rose 0.09% against the USD and closed at 1.0790 on Friday, lifted by the release of upbeat manufacturing and services PMIs across the Euro-zone that pointed towards strong economic activity across the bloc.

The Euro-zone’s preliminary Markit manufacturing PMI unexpectedly advanced to a nearly seven-year high level of 56.2 in March, defying market expectations for a fall to a level of 55.3 and compared to a level of 55.4 in the prior month. Additionally, the region’s flash Markit services PMI surprisingly climbed to a level of 56.5 in March, notching its highest level in 71 months. The PMI had recorded a reading of 55.5 in the previous month, while markets were expecting for a fall to a level of 55.3.

Separately, activity in Germany’s manufacturing sector accelerated at its fastest pace in nearly seven-years, after the PMI unexpectedly jumped to a level of 58.3 in March, thus painting a robust growth picture of the nation’s manufacturing sector. Meanwhile, investors had envisaged the PMI to drop to a level of 56.5, compared to a level of 56.8 in the prior month. Moreover, growth in the nation’s services sector advanced more-than-expected to a level of 55.6 in March, expanding at its quickest pace in fifteen months and compared to market consensus for a rise to a level of 54.5. In the prior month, the PMI had recorded a level of 54.4.

Macroeconomic data indicated that the US flash Markit manufacturing PMI unexpectedly declined to a five-month low level of 53.4 in March, suggesting a slowdown in the nation’s economic activity. The PMI had recorded a reading of 54.2 in the previous month, compared to market expectations of a rise to a level of 54.8. Further, the nation’s services sector surprisingly eased to a level of 52.9 in March, growing at its slowest pace in six months and confounding market consensus for a rise to a level of 54.0. the PMI had registered a reading of 53.8 in the preceding month.

On the other hand, the nation’s preliminary durable goods orders increased 1.7% in February, buoyed by greater demand for commercial aircraft and surpassing market expectations for a gain of 1.4%. Durable goods orders had advanced 2.0% in the previous month.

Meanwhile, the US House Republican, on Friday, pulled their health-care bill, thus adding to doubts over the Trump administration’s ability to push through its pro-growth economic agenda.

In the Asian session, at GMT0300, the pair is trading at 1.0843, with the EUR trading 0.49% higher against the USD from Friday’s close.

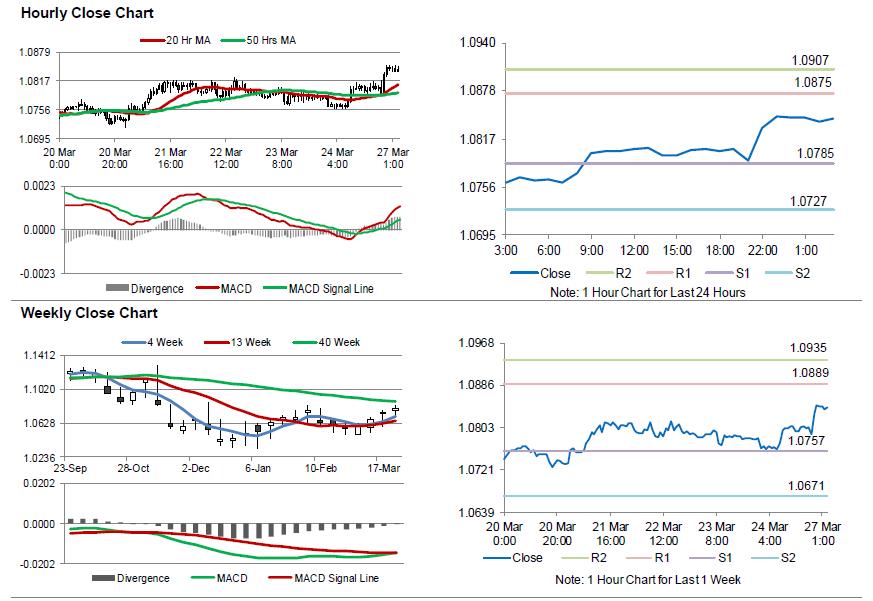

The pair is expected to find support at 1.0785, and a fall through could take it to the next support level of 1.0727. The pair is expected to find its first resistance at 1.0875, and a rise through could take it to the next resistance level of 1.0907.

Going ahead, investors will focus on Germany’s Ifo expectations and business climate indices for March, slated to release in a few hours. Moreover, speeches by the Federal Reserve (Fed) Bank of Chicago President, Charles Evans and Dallas Fed President, Robert Kaplan, both due later in the day, will be eyed by traders.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.