For the 24 hours to 23:00 GMT, the EUR rose 0.67% against the USD and closed at 1.1368 on Friday.

On the macro front, the Euro-zone’s preliminary manufacturing PMI rose to a level of 47.8 in June, undershooting market consensus for a gain to a level of 48.0. In the prior month, the PMI had recorded a level of 47.7. Moreover, the region’s flash services PMI advanced to a level of 53.4 in June, more than market expectations for a rise to a level of 53.0. The PMI had recorded a level of 52.9 in the previous month.

Separately, in Germany, the Markit preliminary manufacturing PMI climbed to a level of 45.4 in June, surpassing market anticipations for a rise to a level of 44.6. In the previous month, the PMI had registered a level of 44.3. Further, the nation’s preliminary services PMI unexpectedly jumped to a level of 55.6 in June, defying market consensus for a fall to a level of 55.2. The PMI had registered a level of 55.4 in the previous month.

In the US data showed that the flash manufacturing PMI unexpectedly fell to a level of 50.1 in June, marking its lowest level since September 2009, amid prolonged weakness in the manufacturing and services sector. In the preceding month, the PMI had recorded a level of 50.5, while market participants had envisaged for a steady reading. Meanwhile, the nation’s flash Markit services PMI surprisingly declined to a level of 50.7 in June, defying market expectations for a gain to a level of 51.0. The PMI had registered a reading of 50.9 in the previous month. Meanwhile, the US existing home sales advanced 2.5% on monthly basis, to a level of 5.3 million in May, compared to a revised level of 5.2 million in the prior month.

In the Asian session, at GMT0300, the pair is trading at 1.1385, with the EUR trading 0.15% higher against the USD from Friday’s close.

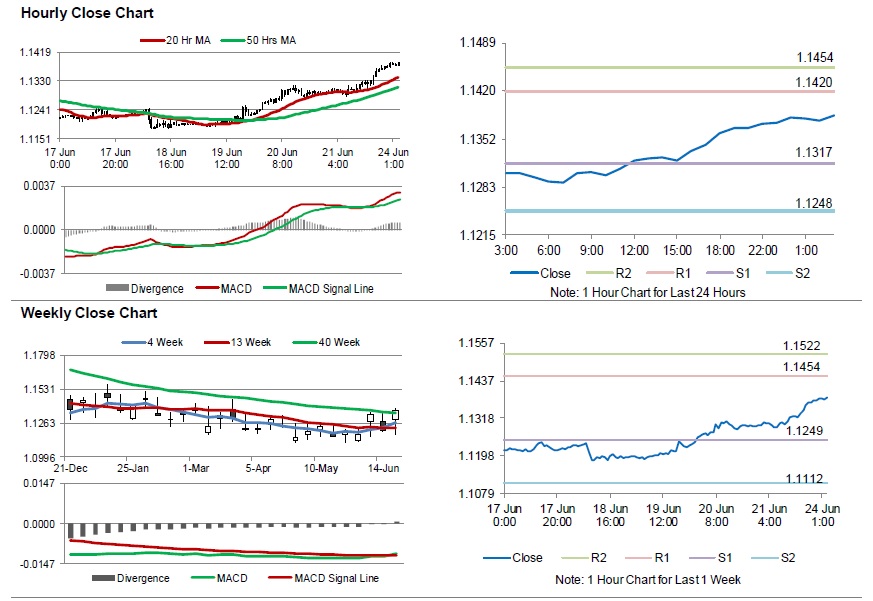

The pair is expected to find support at 1.1317, and a fall through could take it to the next support level of 1.1248. The pair is expected to find its first resistance at 1.1420, and a rise through could take it to the next resistance level of 1.1454.

Looking ahead, traders would await Germany’s IFO survey indices for June, slated to release in a few hours. Later in the day, the US Chicago Fed National Activity Index for May and the Dallas Fed manufacturing activity for June, will garner significant amount of investor’s attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.