For the 24 hours to 23:00 GMT, the EUR declined 0.69% against the USD and closed at 1.1296 on Friday, following downbeat manufacturing data across the euro area.

On the data front, the Euro-zone’s flash manufacturing PMI unexpectedly eased to a level of 47.6 in March, contracting at its fastest pace in around six years and confounding market expectations for a rise to a level of 49.5. In the previous month, the PMI had recorded a level of 49.3. Moreover, the region’s flash services PMI declined to a level of 52.7 in March, at par with market consensus and compared to a level of 52.8 in the prior month.

Separately, in Germany, the preliminary Markit manufacturing PMI unexpectedly fell to a level of 44.7 in March, contracting for the third consecutive month and compared to a reading of 47.6 in the prior month. Market participants had envisaged the PMI to climb to a level of 48.0. Further, the nation’s flash services PMI slid to a level of 54.9 in March, compared to a level of 55.3 in the prior month. Market participants had anticipated the PMI to drop to a level of 54.8.

In the US, data indicated that the US the preliminary Markit manufacturing PMI unexpectedly dropped to a 21-month low level of 52.5 in March, defying market expectations for an advance to a level of 53.5. In the previous month, the PMI had recorded a reading of 53.0. Also, the nation’s preliminary Markit services PMI eased to a level of 54.8 in March, overshooting market expectations for a fall to a level of 55.5. In the preceding month, the PMI had registered a level of 56.0.

On the other hand, the US existing home sales surged 11.8% on a monthly basis, to a level of 5.5 million in February, compared to a revised level of 4.9 million in the previous month. Market participants had envisaged existing home sales to rise to 5.1 million.

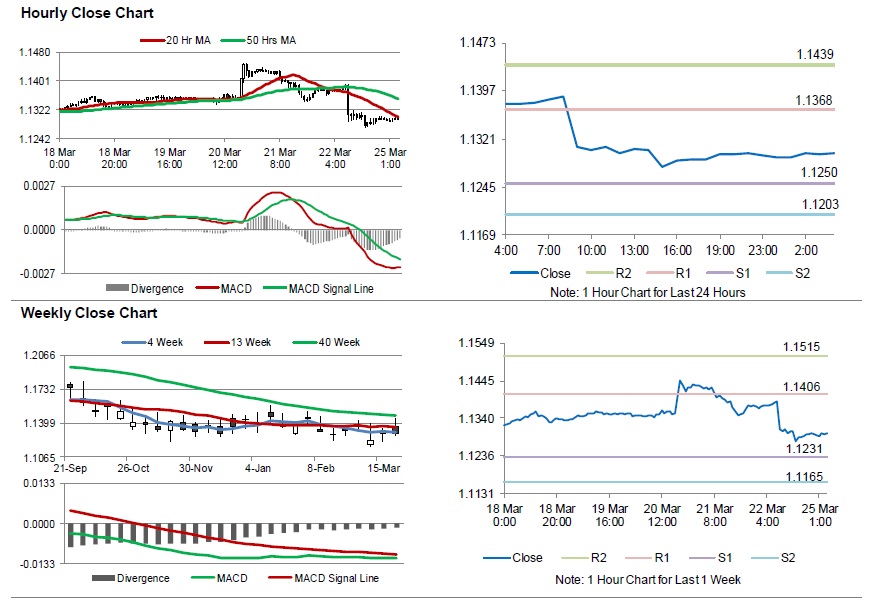

In the Asian session, at GMT0400, the pair is trading at 1.1298, with the EUR trading a tad higher against the USD from Friday’s close.

The pair is expected to find support at 1.1250, and a fall through could take it to the next support level of 1.1203. The pair is expected to find its first resistance at 1.1368, and a rise through could take it to the next resistance level of 1.1439.

Looking forward, traders would keep an eye on Germany’s IFO survey indices, for March, set to release in a few hours. Later in the day, the US Chicago Fed national activity index for February and the Dallas Fed manufacturing activity for March, will pique significant amount of investor’s attention.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.