For the 24 hours to 23:00 GMT, the EUR slightly rose against the USD and closed at 1.1080.

On the data front, Euro-zone’s final manufacturing PMI contracted to a level of 46.5 in July, declining to its lowest level since late 2012 and compared to a preliminary reading of 46.4. In the previous month, the PMI had recorded a level of 47.6.

Separately, in Germany, the final manufacturing PMI fell to a seven-year low level of 43.2 in July, weighed down by steep drop in new export orders since 2009 and compared to a preliminary reading of 43.1. In the previous month, the PMI had recorded a level of 45.0 in the previous month.

The US dollar declined against its major peers, after US President Donald Trump stated that the US would impose more tariffs on China.

In the US, data showed that the final Markit manufacturing PMI dropped to a level of 50.4 in July, hitting its lowest level since September 2009 and less than market expectations for a fall to a level of 50.1. In the prior month, the PMI had recorded a reading of 50.6, while preliminary figures had indicated a decrease to a level of 50.0. Moreover, the US ISM manufacturing activity index unexpectedly eased to a level of 51.2 in August, compared to a reading of 51.7 in the previous month. Also, the nation’s construction spending unexpectedly fell to a seven-month low level by 1.3% on a monthly basis in June, defying market expectations for an advance of 0.3%. In the previous month, construction spending had recorded a revised fall of 0.5%. Additionally, the seasonally adjusted initial jobless claims rose to a level of 215.0K on a weekly basis in the week ended 27 July 2019, compared to market expectations for a rise to a level of 214.0K. Initial jobless claims had recorded a revised reading of 207.0K in the previous week.

In the Asian session, at GMT0300, the pair is trading at 1.1075, with the EUR trading 0.05% lower against the USD from yesterday’s close.

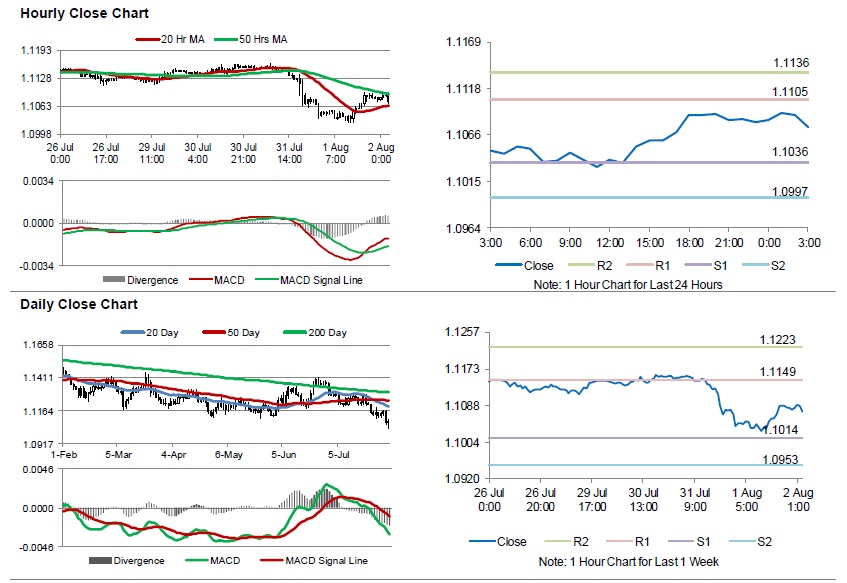

The pair is expected to find support at 1.1036, and a fall through could take it to the next support level of 1.0997. The pair is expected to find its first resistance at 1.1105, and a rise through could take it to the next resistance level of 1.1136.

Looking ahead, traders would keep an eye on Euro-zone’s producer price index and retail sales, both for June, slated to release in a few hours. Later in the day, the US non-farm payrolls, unemployment rate, average hourly earnings and the Michigan consumer sentiment index, all for July as well as trade balance data, factory orders and durable goods orders, all for June, will garner significant amount of investors’ attention.

The currency pair is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average.