For the 24 hours to 23:00 GMT, the EUR rose 0.11% against the USD and closed at 1.0871, after the Euro-zone’s manufacturing and services sector showed strong performance in October, indicating economic recovery picked up pace in the common currency region.

The flash Markit manufacturing PMI in the Euro-zone strengthened more-than-expected to a level of 53.3 in October, expanding at the fastest pace in thirty-months, compared to market expectations of an advance to a level of 52.7 and following a level of 52.6 in the previous month. Additionally, the region’s preliminary Markit services PMI rose to a nine-month high level of 53.5 in October, surpassing market expectations of a rise to a level of 52.4 and after recording a reading of 52.2 in the preceding month.

Separately, activity in Germany’s manufacturing sector expanded to a level of 55.1 in October, accelerating at the strongest pace since January 2014, suggesting that the Euro-zone’s largest economy is regaining momentum. The index recorded a reading of 54.3 in the prior month while markets anticipated it to climb to a level of 54.4. Moreover, the nation’s services sector jumped to the highest level in three months, after it advanced to a level of 54.1 in October, against market expectations of an advance to a level of 51.5 and following a level of 50.9 in the previous month.

Macroeconomic data indicated that, the preliminary Markit manufacturing PMI in the US unexpectedly climbed to a level of 53.2 in October, notching its highest level in twelve-months, thus bolstering the case of a Fed interest rate hike in December. Markets expected the index to remain steady at a level of 51.5, recorded in the prior month. Meanwhile, the nation’s Chicago Fed national activity index improved to a level of -0.14 in September, following a revised reading of -0.72 in the previous month.

Meanwhile, the US St. Louis Fed President, James Bullard, continued to promote one rate hike this year and added that interest rates were likely to remain low for the next two to three years. Meanwhile, the Chicago Fed President, Charles Evans, stated that the central bank is likely to raise its policy rate three more times by the end of next year. He also suggested that the Fed may need to keep interest rates lower for longer to show investors and public that it is committed to achieve its 2% inflation goal sooner rather than later.

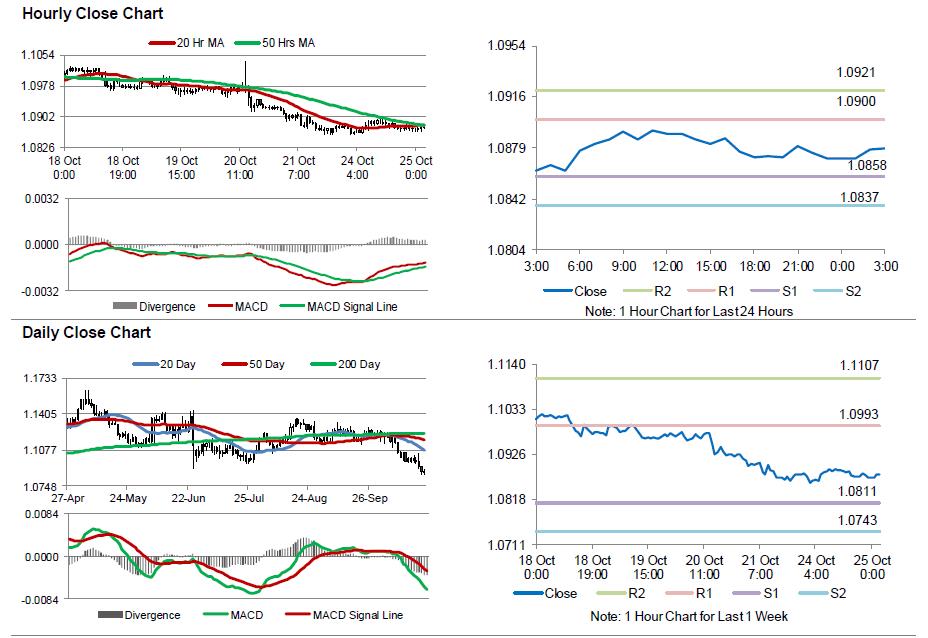

In the Asian session, at GMT0300, the pair is trading at 1.0879, with the EUR trading 0.07% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.0858, and a fall through could take it to the next support level of 1.0837. The pair is expected to find its first resistance at 1.0900, and a rise through could take it to the next resistance level of 1.0921.

Moving ahead, market participants would closely monitor a speech by the ECB President, Mario Draghi, due later today. Additionally, investors would also focus on Germany’s IFO business climate and expectations indices, both for October, slated to release in a few hours. Moreover, in the US, consumer confidence index for October and house price index for August, scheduled to be released later in the day, would pique investor attention.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.