For the 24 hours to 23:00 GMT, the EUR declined 0.37% against the USD and closed at 1.1021 on Friday.

On the data front, Euro-zone’s preliminary manufacturing PMI advanced to a 3-month high level of 46.6 in November, surpassing market expectations for a rise to a level of 46.4. In the prior month, the PMI had recorded a level of 45.9. Meanwhile, the region’s preliminary services PMI unexpectedly fell to a level of 51.5 in November, defying market consensus for an increase to a level of 52.5. In the previous month, the PMI had registered a level of 52.2.

Separately, in Germany, the seasonally adjusted final gross domestic product (GDP) advanced 0.1% on a quarterly basis in 3Q 2019, in line with market expectations and confirming the preliminary figures. The GDP had recorded a revised drop of 0.2% in the previous quarter. Moreover, the nation’s Markit preliminary manufacturing PMI rose to a level of 43.8 in November, more than market anticipations for an advance to a level of 42.9. The PMI had registered a level of 42.1 in the prior month.

On the other hand, Germany’s preliminary services PMI surprisingly declined to its lowest level in 38 months to 51.3 in November, defying market expectations for a rise to a level of 52.0. In the previous month, the PMI had recorded a reading of 51.6.

The European Central Bank President, Christine Lagarde, suggested that the European government should enhance innovation and growth by raising its public investment. In her opinion, the escalating US-China tariff war should be considered as prospect for reinforcing the region’s internal market in order to support its private sector investment resulting into an improvement of the euro bloc’s performance as well as boost crisis recovery.

The US dollar gained ground against a basket of currencies, amid upbeat manufacturing and services sector activity data.

In the US, data showed that the Markit manufacturing PMI climbed to a 7-month high level of 52.2 in November, compared to a level of 51.3 in the prior month. Market participants had anticipated the PMI to rise to a level of 51.5. Likewise, the nation’s flash services PMI advanced to a level of 51.6 in November, marking its highest level in 4 months and higher than market consensus for a rise to a level of 51.0. The PMI had recorded a reading of 50.6 in the previous month. Also, the US final Reuters/Michigan consumer sentiment index rose to a 4-month high level of 96.8 November, benefitting from lower interest rates and waning US-China trade tensions. In the prior month, the index had recorded a reading of 95.5 in the previous month, while the preliminary figures had recorded an advance to a level of 95.7.

In the Asian session, at GMT0400, the pair is trading at 1.1020, with the EUR trading a tad lower against the USD from Friday’s close.

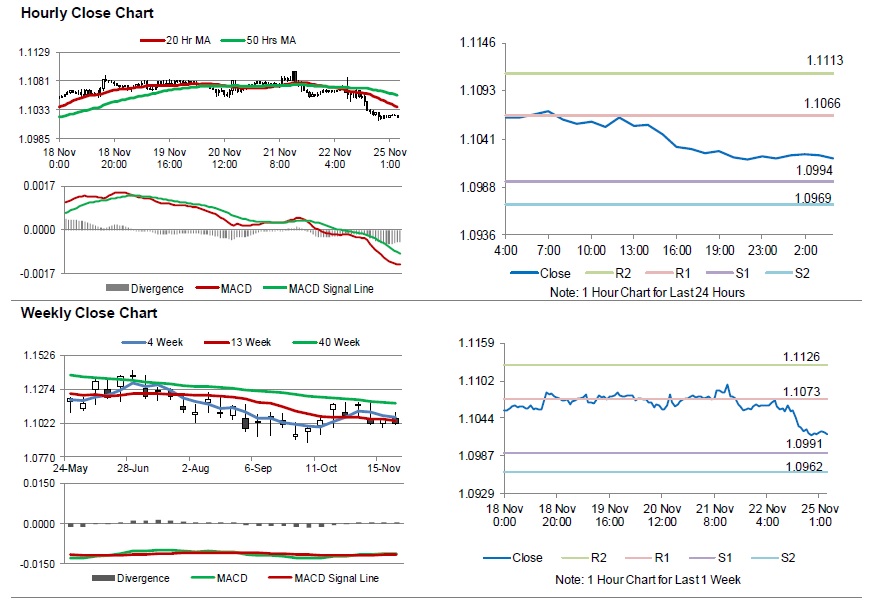

The pair is expected to find support at 1.0994, and a fall through could take it to the next support level of 1.0969. The pair is expected to find its first resistance at 1.1066, and a rise through could take it to the next resistance level of 1.1113.

Looking ahead, traders would keep an eye on Germany’s Ifo survey indices for November, set to release in a few hours. Later in the day, the US Chicago Fed National Activity Index for October and the Dallas Fed Manufacturing Business Index for November would garner significant amount of investor attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.