For the 24 hours to 23:00 GMT, the EUR declined 0.26% against the USD and closed at 1.0994, amid dismal PMI data across the euro bloc.

On the macro front, Euro-zone’s flash manufacturing PMI unexpectedly eased to a seven-year low level of 45.6 in September. In the previous month, the PMI had recorded a level of 47.0. Moreover, the region’s preliminary services PMI fell to its lowest level in 8 months by 52.0 in September, more than market expectations of a decline to a level of 53.3. In the previous month, the PMI had registered a reading of 53.5.

Separately, in Germany, the Markit flash manufacturing PMI surprisingly dropped to a decade low level of 41.4 in September, defying market anticipation for an advance to a level of 44.2. the PMI had recorded a reading of 43.5 in the prior month. Further, the nation’s preliminary services PMI declined more-than-estimated to a level of 52.5 in September, falling for the first time in six years and compared to a level of 54.80 in the previous month. Market participants had envisaged the PMI to record a fall to a level of 54.20.

The European Central Bank President Mario Draghi suggested the Governing Council to consider ideas such as Modern Monetary Theory (MMT) and noted that the government should direct the finalisation of the fiscal policy. Further, Draghi highlighted the possibility of including Greece in its asset purchase program if it improves in implementing reforms.

In the US, data showed that the Markit manufacturing PMI unexpectedly advanced to a 5-month high level of 51.0 in September, defying market consensus for a decline to a level of 50.1. In the preceding month, the PMI had recorded a level of 50.3. Also, the nation’s preliminary services PMI rose to a level of 50.9 in September, compared to market anticipation for an increase to a level of 51.2. In the prior month, the PMI had recorded a level of 50.7. Additionally, the US Chicago Fed national activity index climbed to a level of 0.1 in August, following a revised level of -0.4 in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.0991, with the EUR trading marginally lower against the USD from yesterday’s close.

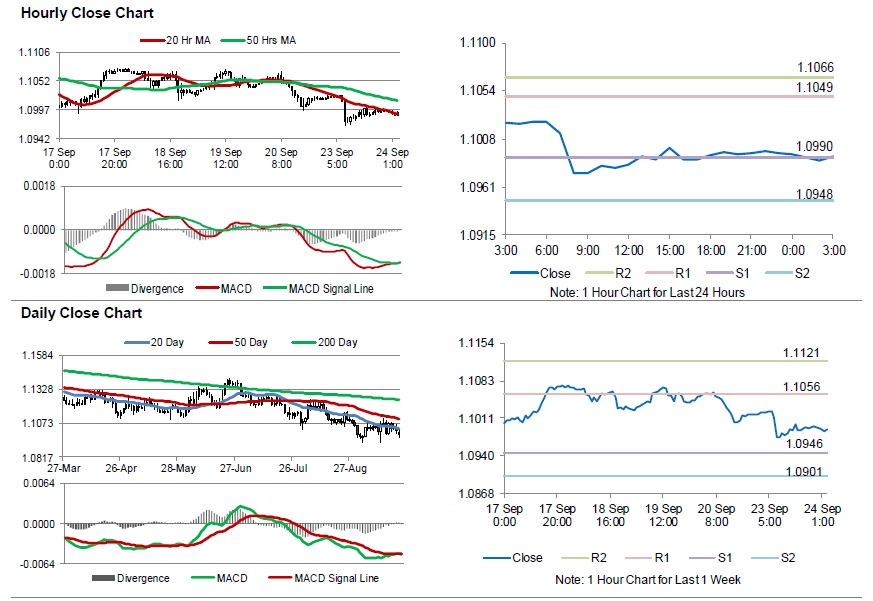

The pair is expected to find support at 1.0990, and a fall through could take it to the next support level of 1.0948. The pair is expected to find its first resistance at 1.1049, and a rise through could take it to the next resistance level of 1.1066.

Moving ahead, traders would await Germany’s Ifo current assessment, business climate and business expectations for September, set to release in a few hours. Later in the day, the US housing price index for July, the Richmond Fed manufacturing index and consumer confidence for September, slated to release later in the day.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.