For the 24 hours to 23:00 GMT, the EUR rose 0.34% against the USD and closed at 1.1196 on Friday, after the Euro-zone’s flash Markit manufacturing PMI unexpectedly rose to a level of 57.3 in June, expanding at its fastest pace in more than six years, thus suggesting that robust manufacturing sector will help drive growth in the region’s economy. Market participants had expected the PMI to drop to a level of 56.8, following a level of 57.0 in the previous month. On the other hand, the region’s preliminary Markit services PMI dropped more-than-expected to a five-month low level of 54.7 in June, after registering a reading of 56.3 in the previous month, while investors had envisaged it to ease to a level of 56.1.

Separately, activity in Germany’s manufacturing sector eased less-than-expected to a level of 59.3 in June, compared to market expectations of a fall to a level of 59.0. In the previous month, the PMI had recorded a level of 59.5. Further, the nation’s services sector expanded at its weakest pace in 5 months in June, after the PMI surprisingly eased to a level of 53.7, defying market consensus for the PMI to remain steady at a level of 55.4 registered in the prior month.

The greenback ended lower against its major peers on Friday, after weaker-than-expected US manufacturing and services sector data pointed to a slowdown in the world’s largest economy.

Data showed that the US preliminary Markit manufacturing PMI unexpectedly eased to a level of 52.1 in June, hitting its lowest level in nine months and confounding market consensus for an advance to a level of 53.0. In the previous month, the PMI had recorded a reading of 52.7. Moreover, the nation’s services sector growth eased to a 3-month low level of 53.0 in June, higher than market expectations of a drop to a level of 53.5. In the preceding month, the PMI had recorded a reading of 53.6. On the contrary, the nation’s new home sales rebounded less-than-anticipated by 2.9% on a monthly basis in May, compared to a revised fall of 7.9% in the preceding month.

Meanwhile, St. Louis Federal Reserve (Fed) President, James Bullard, stated that the Fed should wait on further rate hikes until inflation was moving towards the central bank’s target.

In the Asian session, at GMT0300, the pair is trading at 1.1194, with the EUR trading slightly lower against the USD from Friday’s close.

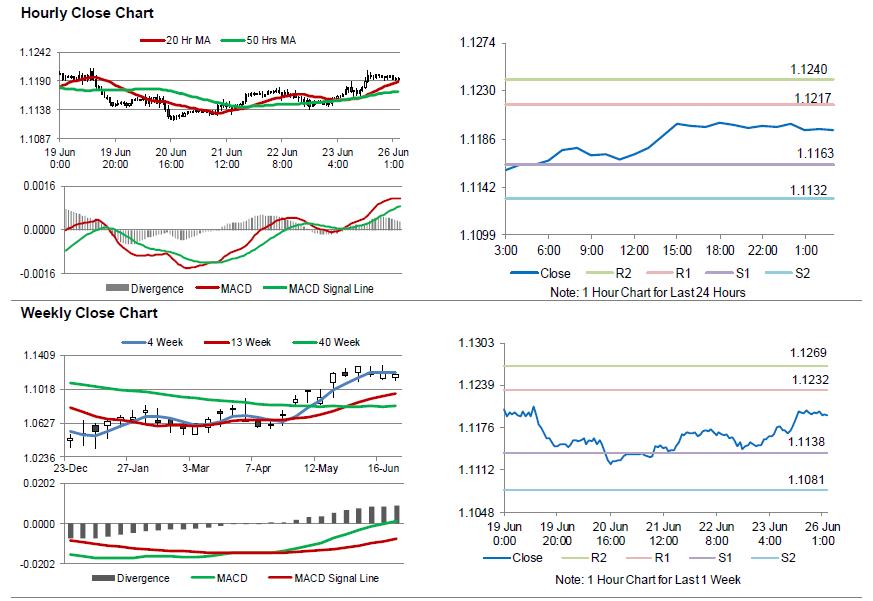

The pair is expected to find support at 1.1163, and a fall through could take it to the next support level of 1.1132. The pair is expected to find its first resistance at 1.1217, and a rise through could take it to the next resistance level of 1.1240.

Going ahead, investors will keep a close watch on Germany’s Ifo expectations and business climate indices, both for June, slated to release in a few hours. Moreover, the US flash durable goods orders for May, due to release later in the day, will be on investors’ radar.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.