For the 24 hours to 23:00 GMT, the EUR declined 0.45% against the USD and closed at 1.2280, following a slew of downbeat economic releases across the Euro-zone.

Data revealed that the Euro-zone’s preliminary Markit manufacturing PMI dropped more-than-expected to a level of 58.5 in February, hitting its lowest level in 4 months. In the prior month, the PMI had registered a level of 59.6, while investors had envisaged for a fall to a level of 59.2.

Moreover, the region’s flash Markit services PMI registered a 2-month low level of 56.7 in February, compared to market expectations for a fall to a level of 57.6. In the previous month, the PMI had registered a reading of 58.0.

Separately, growth in Germany’s manufacturing sector cooled to a level of 60.3 in February, expanding at its weakest pace in 6 months. Market anticipation was for the PMI to ease to a level of 60.5, after registering a reading of 61.1 in the prior month. Additionally, the nation’s services sector activity eased more-than-anticipated to a level of 55.3 in February, marking its slowest pace of growth in 3 months. The PMI had registered a level of 57.3 in the prior month, while markets were expecting for a drop to a level of 57.0.

The greenback advanced against its major peers, following upbeat minutes of the Federal Reserve’s (Fed) January meeting.

As per the minutes, officials painted an upbeat picture of the US economy and were increasingly optimistic on reaching their 2.0% inflation target over the medium term. Further, many officials upgraded their economic growth forecasts and pointed to the recent tax cuts as well as the improved global economic outlook as factors contributing to the US economic growth this year. Additionally, committee members shared the view that a strengthening economy supported future gradual interest rates hikes, while cautioning that the impact of the tax cuts is not yet clear.

Gains in the US Dollar were boosted further, after macroeconomic data revealed that activity in the US manufacturing sector recorded an unexpected rise to a level of 55.9 in February, accelerating by the most in over 3 years, thus highlighting a solid upturn in business conditions. In the previous month, the PMI had recorded a level of 55.5, while market participants had expected for an unchanged reading. Moreover, the nation’s services sector growth surged to a 6-month high level of 55.9 in February, beating market anticipations for a rise to a level of 53.7. the PMI had registered a level of 53.3 in the previous month.

Other economic data indicated that existing home sales in the US surprisingly eased 3.2% on a monthly basis to a level of 5.38 million in January, defying market expectations for a rise to a level of 5.60 million. Existing home sales had registered a revised reading of 5.56 million in the previous month. Also, the nation’s MBA mortgage applications fell 6.6% in the week ended 16 February, following a drop of 4.1% in the previous week.

In the Asian session, at GMT0400, the pair is trading at 1.2276, with the EUR trading a tad lower against the USD from yesterday’s close.

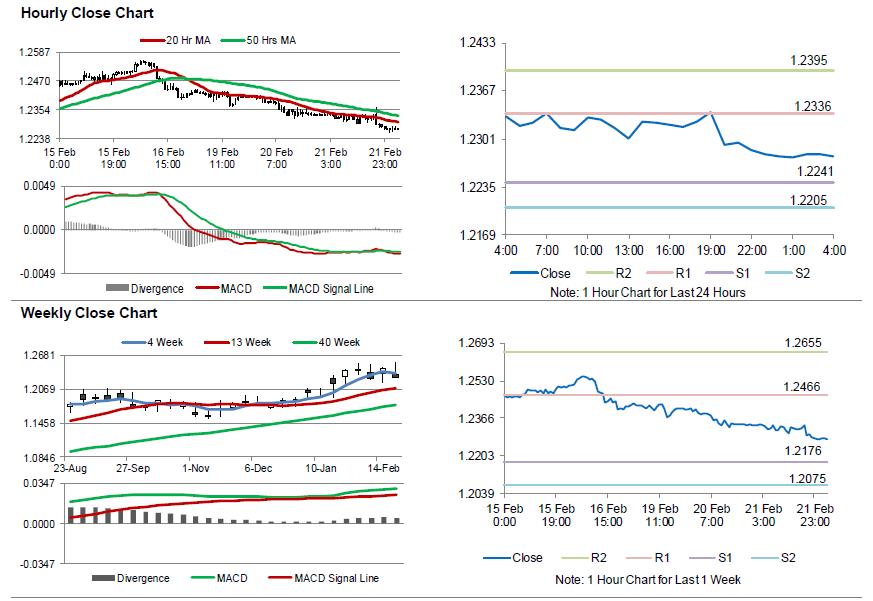

The pair is expected to find support at 1.2241, and a fall through could take it to the next support level of 1.2205. The pair is expected to find its first resistance at 1.2336, and a rise through could take it to the next resistance level of 1.2395.

Ahead in the day, traders would keep a close watch on the European Central Bank’s (ECB) latest meeting minutes as well as Germany’s Ifo business climate and expectations indices for February. Moreover, the US initial jobless claims followed by the leading index for January, slated to release later in the day, would attract a lot of market attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.