For the 24 hours to 23:00 GMT, the EUR slightly rose against the USD and closed at 1.1944 on Friday, after the latest data suggested that economic recovery across the Euro-zone retained its momentum at the end of the third quarter.

Data indicated that the Euro-zone’s flash Markit manufacturing PMI surprisingly advanced to a level of 58.2 in September, expanding at its quickest pace since February 2011. Market participants had envisaged the PMI to drop to a level of 57.2, after recording a level of 57.4 in the previous month. Additionally, the region’s preliminary Markit services PMI jumped to a level of 55.6 in September, notching a four-month high level and beating market consensus for an advance to a level of 54.8. In the previous month, the PMI had registered a reading of 54.7.

Separately, activity in Germany’s manufacturing sector unexpectedly surged to a more than six-year high level of 60.6 in September, confounding market expectations for a drop to a level of 59.0. In the previous month, the PMI had registered a reading of 59.3. Moreover, the nation’s services sector growth accelerated to a six-month high level of 55.6 in September, while markets were anticipating it to climb to a level of 53.7. In the previous month, the PMI had registered a reading of 53.5.

The greenback nursed losses against a basket of major currencies on Friday, on the heels of simmering tensions on the Korean peninsula, after North Korea stated that it might test a hydrogen bomb in the Pacific Ocean in response to the US President, Donald Trump’s warning to destroy the isolated nation.

The preliminary Markit manufacturing PMI in the US rose to a level of 53.0 in September, meeting market expectations and hitting a two-month high level. The PMI had recorded a level of 52.8 in the prior month.

On the other hand, the nation’s flash Markit services PMI declined to a two-month low level of 55.1 in September, worse than market expectations for a fall to a level of 55.8 and following a reading of 56.0 in the prior month.

In the Asian session, at GMT0300, the pair is trading at 1.1931, with the EUR trading 0.11% lower against the USD from Friday’s close, after the German Chancellor, Angela Merkel, won a fourth term but was left struggling to form a governing coalition.

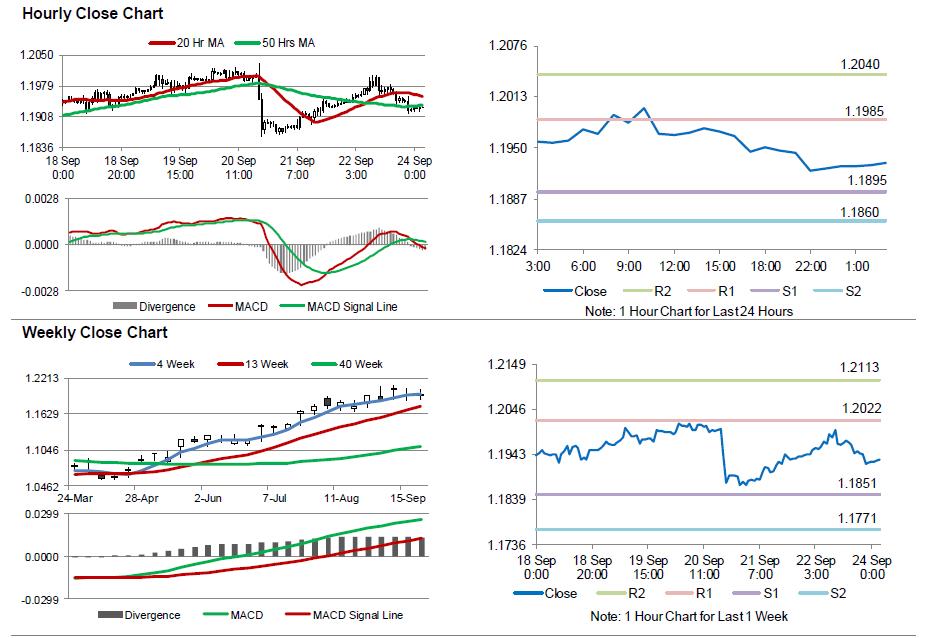

The pair is expected to find support at 1.1895, and a fall through could take it to the next support level of 1.1860. The pair is expected to find its first resistance at 1.1985, and a rise through could take it to the next resistance level of 1.2040.

Moving ahead, investors will look forward to Germany’s Ifo expectations and business climate indices, both for September, slated to release in a few hours. Additionally, ECB Chief, Mario Draghi’s speech, due later today, will be assessed by traders.

The currency pair is trading below its 20 Hr moving average and showing convergence with its 50 Hr moving average.