For the 24 hours to 23:00 GMT, the EUR declined 0.07% against the USD and closed at 1.1397 on Friday.

On the data front, the Euro-zone’s final manufacturing PMI fell to a 26-month low level of 52.0 in October, exceeding market expectations for a fall to a level of 52.1 and compared to a reading of 53.2 in the previous month. The preliminary figures had indicated a drop to a level of 52.1. Meanwhile, in Germany, the Markit final manufacturing PMI slid to a level of 52.2 in October, hitting its lowest level in 29-months and compared to a level of 53.7 in the previous month. The preliminary figures had indicated a drop to 52.3.

The US dollar gained ground against major currencies, following stronger than expected jobs data.

In the US, the US non-farm payrolls climbed 250.0K in October, compared to a revised advance of 118.0K in the prior month. Markets had anticipated non-farm payrolls to rise a level of 200.0K. Further, average hourly earnings of all employees rose 3.1% on an annual basis in October, at par with market expectations and growing at its fastest pace since 2009. In the previous month, average hourly earnings of all employees had advanced 2.8%. Additionally, the nation’s final durable goods orders advanced 0.7% on a monthly basis in September, compared to a revised rise of 4.6% in the previous month. The preliminary figures had recorded an advance of 0.8%. Furthermore, factory orders rose 0.7% on a monthly basis in September, higher than market consensus for a gain of 0.5%. In the prior month, factory orders had recorded a revised rise of 2.6%. Moreover, unemployment rate remained unchanged at a rate of 3.7% in October, in line with market expectations.

On the other hand, data showed that trade deficit widened more-than-anticipated to $54.0 billion in September, expanding to a seven-month high level. In the previous month, the region had recorded a revised deficit of $53.3 billion.

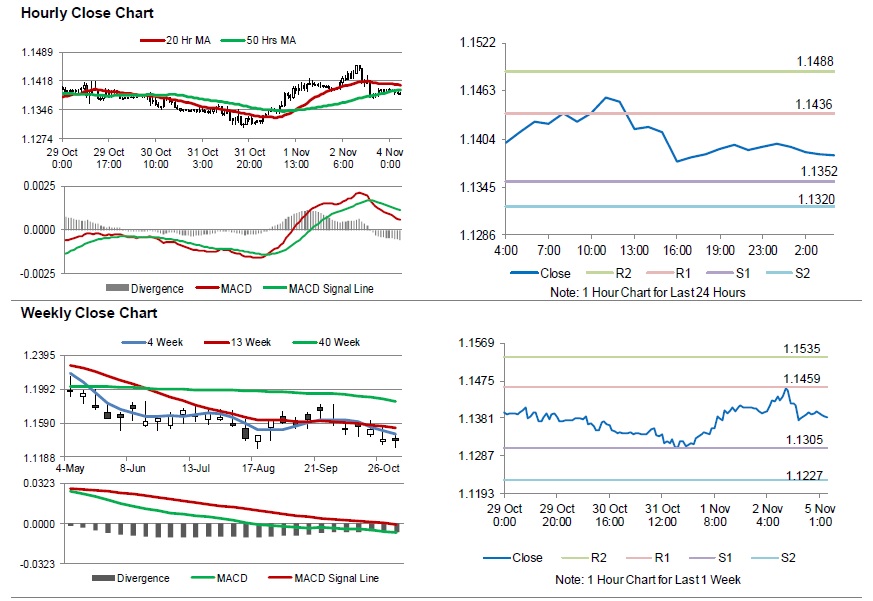

In the Asian session, at GMT0400, the pair is trading at 1.1384, with the EUR trading 0.11% lower against the USD from Friday’s close.

The pair is expected to find support at 1.1352, and a fall through could take it to the next support level of 1.1320. The pair is expected to find its first resistance at 1.1436, and a rise through could take it to the next resistance level of 1.1488.

Moving ahead, investors would await the Euro-zone’s Sentix investor confidence for November, set to release in a few hours. Later in the day, the US flash Markit services PMI for October, will pique significant amount of investors attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.