For the 24 hours to 23:00 GMT, the EUR declined 0.21% against the USD and closed at 1.1664.

On the data front, Euro-zone’s the final manufacturing PMI advanced to a level of 55.1 in July, confirming the preliminary print and at par with market expectations. In the prior month, the index had recorded a reading of 54.9. Separately, in Germany, the final manufacturing PMI climbed to a level of 56.9 in July, undershooting market expectations for a rise to a level of 57.3. In the previous month, the PMI had recorded a reading of 55.9, while preliminary figures had indicated an advance to 57.3.

The greenback declined against a basket of currencies, following weak economic data.

Data showed that the US final Markit manufacturing PMI unexpectedly dropped to a 5-month low level of 55.3 in July, defying market expectations for a rise to a level of 55.5. The PMI had registered a reading of 55.4 in the previous month. Further, construction spending unexpectedly eased 1.1% on a monthly basis in June. In the prior month, construction spending had climbed by a revised 1.3%. The ISM manufacturing activity index recorded a drop to 58.10 in July, more than market expectations. In the previous month, the ISM manufacturing activity index had registered a reading of 60.20. Moreover, the MBA mortgage applications slid for the third consecutive week by 2.6%, on a weekly basis in the week ended 27 July 2018, following a decline of 0.2% in the prior week. On the contrary, the ADP private sector employment recorded a more-than-expected increase of 219.00K in the US. The private sector employment had recorded a gain of 177.00K in the previous month.

Separately, the Federal Reserve (Fed), at its latest monetary policy meeting, unanimously voted to maintain the target range for the federal funds rate at 1.75% and 2.00% and signalled for further rate hike in September followed by next hike likely in December. In a statement accompanying the decision, the central bank stated that the economy is growing at a “strong rate” and labour market is strengthening, with inflation near its 2.0% target. .

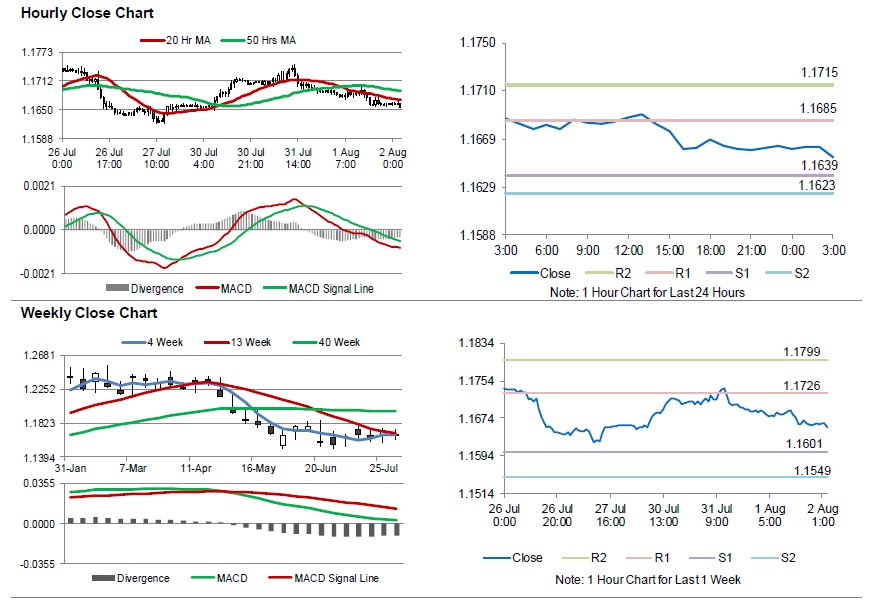

In the Asian session, at GMT0300, the pair is trading at 1.1654, with the EUR trading 0.09% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.1639, and a fall through could take it to the next support level of 1.1623. The pair is expected to find its first resistance at 1.1685, and a rise through could take it to the next resistance level of 1.1715.

Going forward, investors’ will closely monitor the Euro-zone’s producer price index for June, slated to release in a few hours. Later in the day, the US initial jobless claims followed by factory orders and durable goods orders, both for June, will keep traders on their toes.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.