For the 24 hours to 23:00 GMT, the EUR declined 0.41% against the USD and closed at 1.1864 on Friday.

In economic news, the Euro-zone’s final Markit manufacturing PMI climbed to a level of 57.4 in August, confirming the flash print. In the previous month, the PMI had registered a level of 56.6.

Separately, Germany’s final Markit manufacturing PMI rose less than initially estimated to a level of 59.3 in August, compared to an advance to a level of 59.4 indicated in the flash estimate. In the preceding month, the PMI had registered a reading of 58.1 in the previous month.

The greenback gained ground against its key peers, as investors shrugged-off disappointing US non-farm payrolls report and cheered robust ISM manufacturing data.

Data indicated that non-farm payrolls in the US rose by 156.0K in August, falling well short of market expectations for an advance of 180.0K. Non-farm payrolls had recorded a revised increase of 189.0K in the prior month. Further, the nation’s average hourly earnings of all employees posted a sluggish gain of 0.1% on a monthly basis in August, spurring fresh doubts that whether the Federal Reserve would be able to stick to its timetable for further interest rate rises as wage growth remains anaemic. Average hourly earnings of all employees had registered a rise of 0.3% in the prior month, while market participants had envisaged for a rise of 0.2%. Moreover, the nation’s unemployment rate registered an unexpected rise to 4.4% in August, while markets anticipated it to remain steady at 4.3%.

In other economic news, the US ISM manufacturing activity index jumped more-than-expected to a level of 58.8 in August, expanding at its fastest pace in six-years, suggesting that manufacturing sector will remain a key pillar of growth in the world’s largest economy. The index had registered a level of 56.3 in the previous month, while markets were anticipating for an advance to a level of 56.5. Meanwhile, the nation’s final Reuters/Michigan consumer confidence index recorded a rise to a level of 96.8 in August, while the preliminary figures had indicated a rise to a level of 97.6. The index had registered a level of 93.4 in the previous month. On the other hand, the nation’s construction spending unexpectedly fell 0.6% MoM in July, dipping to a nine-month low and defying market consensus for a rise of 0.5%. Construction spending had posted a revised fall of 1.4% in June. Also, the nation’s final Markit manufacturing PMI eased less than initially estimated to a level of 52.8 in August, compared to a level of 53.3 in the prior month. The preliminary figures had indicated a drop to a level of 52.5.

In the Asian session, at GMT0300, the pair is trading at 1.1885, with the EUR trading 0.18% higher against the USD from Friday’s close.

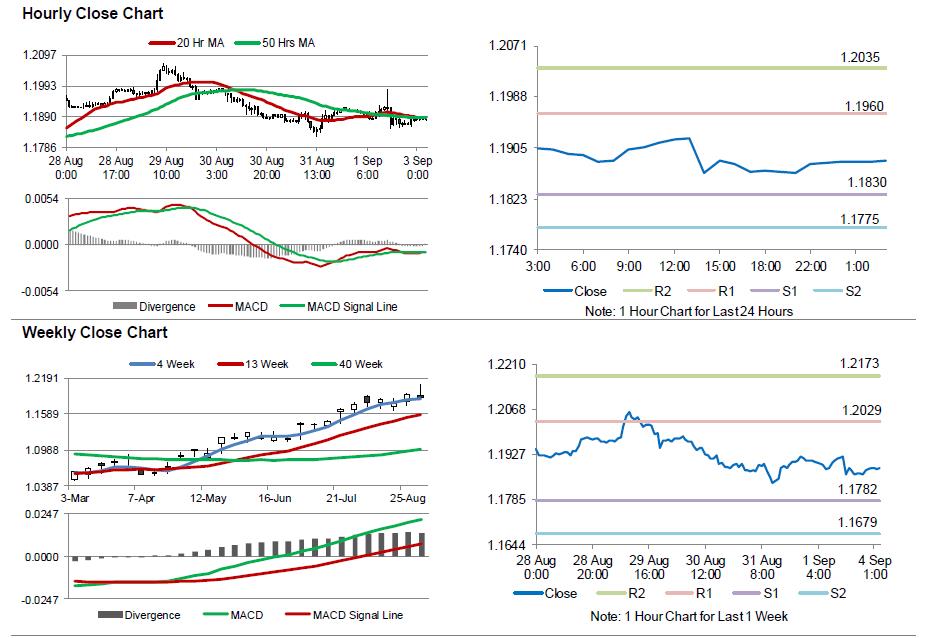

The pair is expected to find support at 1.183, and a fall through could take it to the next support level of 1.1775. The pair is expected to find its first resistance at 1.196, and a rise through could take it to the next resistance level of 1.2035.

Going forward, the Euro-zone’s Sentix investor confidence index for September, scheduled to release in a few hours, will garner significant amount of market attention.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.