For the 24 hours to 23:00 GMT, the EUR marginally declined against the USD and closed at 1.1892 on Friday.

In economic news, the Euro-zone’s final Markit manufacturing PMI rose to a level of 60.1 in November, up from an earlier estimate that indicated an advance to a level of 60.0 and notching its highest level since April 2000. The PMI had registered a level of 58.5 in the previous month.

Moreover, Germany’s final Markit manufacturing PMI advanced to a level of 62.5 in November, confirming the preliminary print. The PMI had recorded a level of 60.6 in the previous month.

The greenback declined against its key counterparts on Friday, after news emerged that former US national security adviser, Michael Flynn, is ready to testify that the US President, Donald Trump directed him to contact Russian officials during the 2016 presidential campaign.

On the macro front, the US ISM manufacturing activity index dropped more-than-anticipated to a level of 58.2 in November, compared to market expectations for a fall to a level of 58.3. The index had registered a level of 58.7 in the prior month. Additionally, the nation’s final Markit manufacturing PMI fell less than initially estimated to a level of 53.9 in November, following a reading of 54.6 in the prior month. The preliminary print had recorded a drop to a level of 53.8.

On the other hand, the nation’s construction spending grew at its fastest pace in five months, after it climbed more-than-anticipated by 1.4% on a monthly basis in October, amid a surge in public construction outlays. Market participants had expected construction spending to advance 0.5%, compared to a gain of 0.3% in the prior month.

In the Asian session, at GMT0400, the pair is trading at 1.1871, with the EUR trading 0.18% lower against the USD from Friday’s close, as the US Dollar gained ground after the US Senate approved a long-awaited tax overhaul over the weekend.

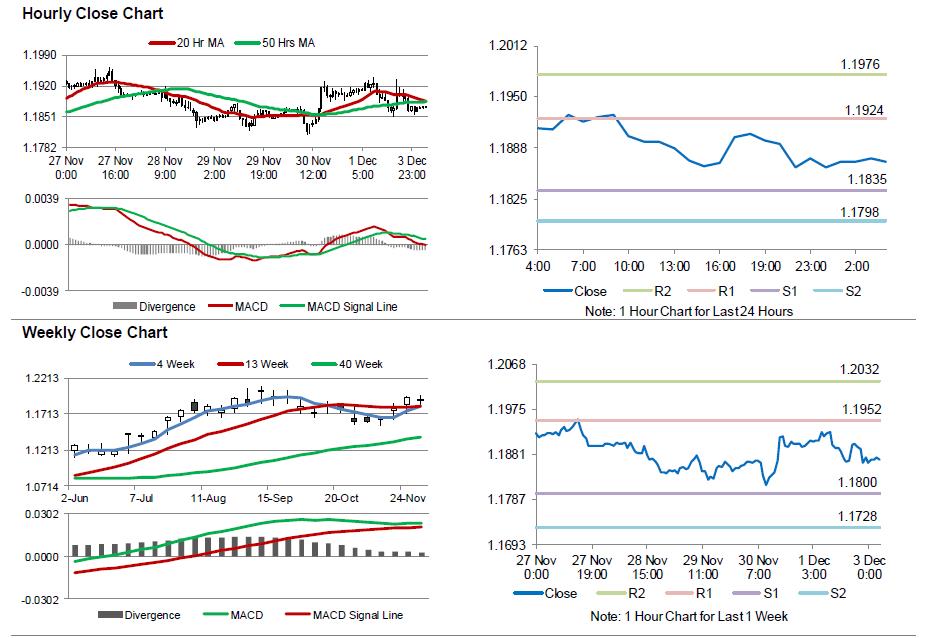

The pair is expected to find support at 1.1835, and a fall through could take it to the next support level of 1.1798. The pair is expected to find its first resistance at 1.1924, and a rise through could take it to the next resistance level of 1.1976.

Going ahead, investors would look forward to the Euro-zone’s Sentix investor confidence index for December, due to release in a few hours. Moreover, the US factory orders and final durable goods orders data, both for October, slated to release later in the day, will attract a lot of market attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.