For the 24 hours to 23:00 GMT, the EUR declined 0.16% against the USD and closed at 1.1187.

The European Central Bank (ECB), in its economic bulletin report, stated that the common currency region outlook remained affected in the second and third quarter of 2019, citing persistent uncertainties along with abate global growth and international trade.

In the US, data showed that the seasonally adjusted initial jobless claims eased to a level of 209.0K in the week ended 03 August 2019, supported by stronger labour market and surpassing market expectations for a drop to a level of 215.0K. In the previous week, initial jobless claims had recorded a revised reading of 217.0K.

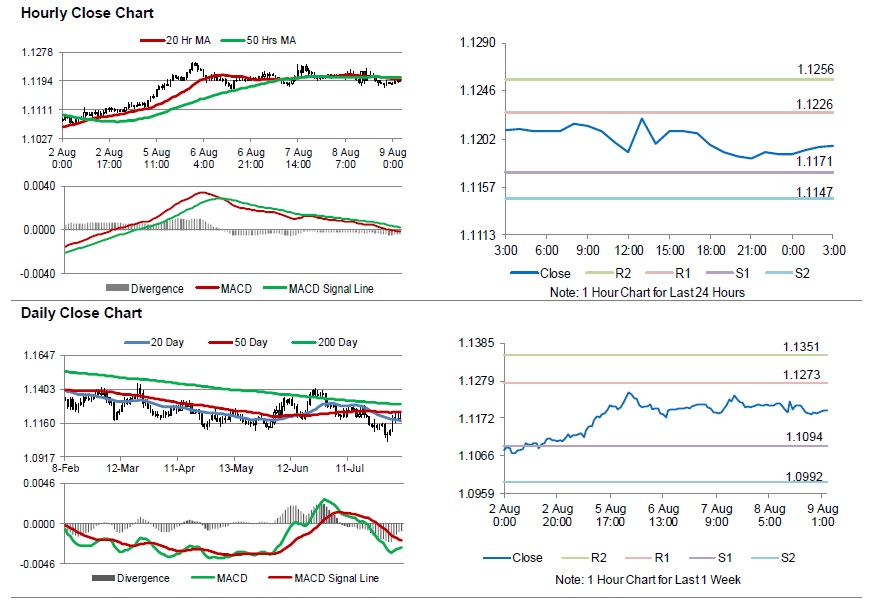

In the Asian session, at GMT0300, the pair is trading at 1.1195, with the EUR trading 0.07% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1171, and a fall through could take it to the next support level of 1.1147. The pair is expected to find its first resistance at 1.1226, and a rise through could take it to the next resistance level of 1.1256.

Moving ahead, traders would await Germany’s trade balance data for June, slated to release in a few hours.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.