For the 24 hours to 23:00 GMT, the EUR marginally rose against the USD and closed at 1.0658 on Friday.

On the data front, the Euro-zone’s producer price index (PPI) advanced more-than-expected by 0.8% on a monthly basis in October, notching its highest level in more than four years, aided by a pick-up in energy prices. The index had advanced by 0.1% in the prior month, while markets expected it to rise by 0.4%.

The US Dollar lost ground against most of its key counterparts on Friday, after the latest jobs report provided a mixed picture of the nation’s labour market.

Non-farm payrolls data indicated that the US economy added 178.0K jobs in November, falling short of market expectations of an advance of 180.0K and compared to a revised gain of 142.0K in the previous month. Additionally, the nation’s unemployment rate unexpectedly dropped to 4.6% in November, hitting its nine-year low level, further cementing the case of a Federal Reserve interest rate hike later this month. Markets had anticipated the unemployment rate to remain steady at 4.9%, recorded in the prior month. On the contrary, the nation’s average hourly earnings of all employees surprisingly fell by 0.1% MoM in November, defying investor consensus for it to gain 0.2%. In the prior month, average hourly earnings of all employees had advanced 0.4%.

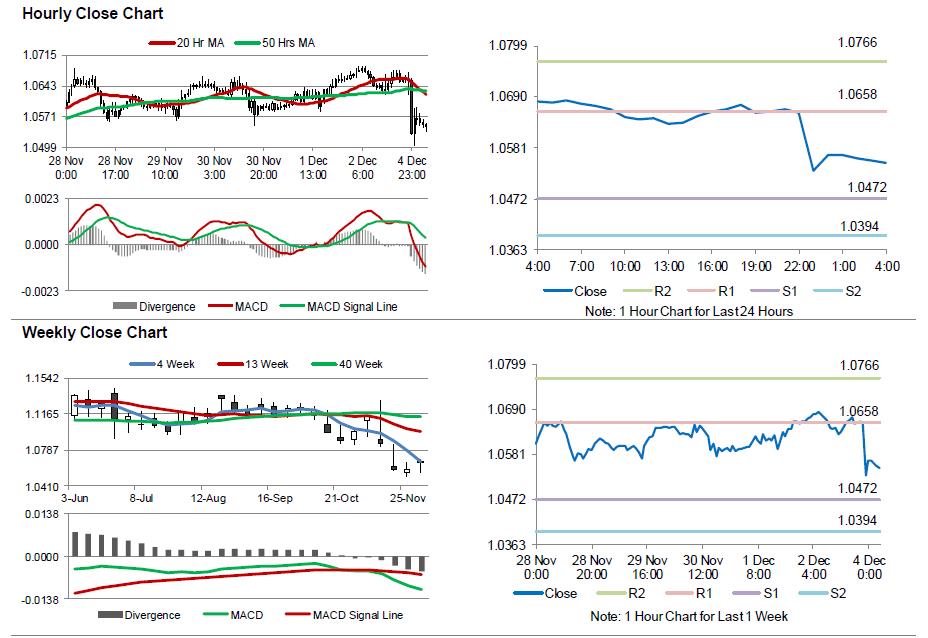

In the Asian session, at GMT0400, the pair is trading at 1.0549, with the EUR trading 1.02% lower against the USD from Friday’s close, after Italians rejected proposed constitutional reforms backed by the government, prompting Prime Minister, Matteo Renzi, to announce his resignation.

The pair is expected to find support at 1.0472, and a fall through could take it to the next support level of 1.0394. The pair is expected to find its first resistance at 1.0658, and a rise through could take it to the next resistance level of 1.0766.

Going ahead, investors will focus on the final Markit services PMI across the Euro-zone along with the region’s Sentix investor confidence and retail sales data, all slated to release in a few hours. Additionally, the US ISM non-manufacturing and the final Markit services PMIs, scheduled to release later today, would keep investors on their toes.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.