For the 24 hours to 23:00 GMT, the EUR declined 0.11% against the USD and closed at 1.1343.

In economic news, the Euro-zone’s producer price index (PPI) advanced 4.9% on a yearly basis in October, beating market expectations for a rise of 4.5%. The PPI had recorded a revised gain of 4.6% in the prior month.

In the Asian session, at GMT0400, the pair is trading at 1.1333, with the EUR trading 0.09% lower against the USD from yesterday’s close.

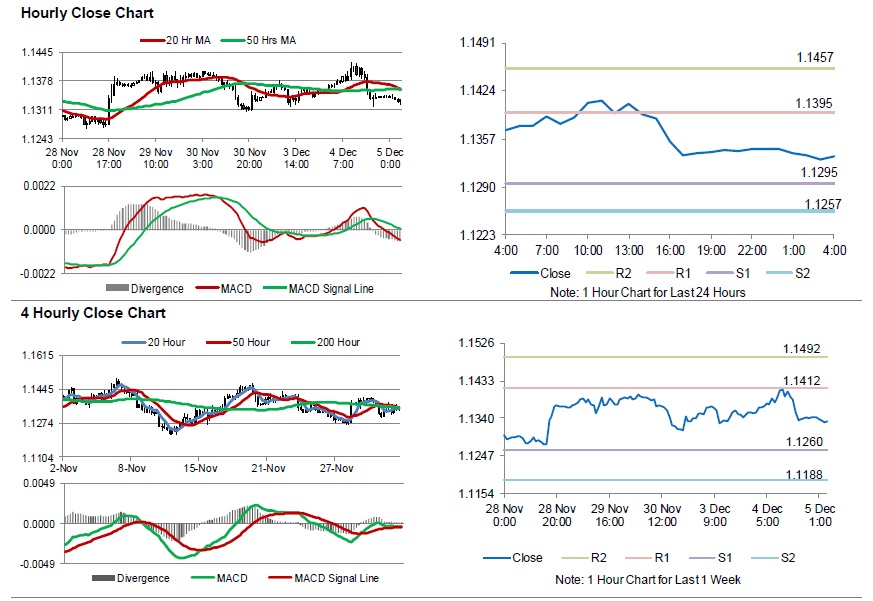

The pair is expected to find support at 1.1295, and a fall through could take it to the next support level of 1.1257. The pair is expected to find its first resistance at 1.1395, and a rise through could take it to the next resistance level of 1.1457.

Looking ahead, investors would keep an eye on the Markit services PMI for November set to release across the euro bloc followed by Euro-zone’s retail sales for October, scheduled to release in a few hours. Later in the day, the US ADP employment change and the Markit services PMI, both for November, will be on investors radar. Additionally, the Federal Reserve’s Beige Book and MBA mortgage applications will keep traders on their toes.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.