For the 24 hours to 23:00 GMT, the EUR rose 0.10% against the USD and closed at 1.1432.

On the macro front, the Euro-zone’s seasonally adjusted retail sales rose 0.8% on an annual basis in September, compared to an advance of 1.8% in the previous month. Market participants had anticipated retail sales to record a gain of 0.9%.

Separately, in Germany, the seasonally adjusted Markit construction PMI declined to a level of 49.8 in October, compared to a level of 50.2 in the prior month. On the other hand, the nation’s seasonally adjusted industrial production unexpectedly climbed 0.2% on a monthly basis in September, rising for the second consecutive month and defying market consensus for a drop of 0.1%. In the preceding month, industrial production had registered a drop of 0.3%.

In the US, data showed that US consumer credit rose to $10.92 billion in September, lower than market expectations for a rise of $15.00 billion, compared to a revised rise of $22.88 billion in the previous month. However, the nation’s mortgage applications eased 4.0% on a weekly basis in the week ended 02 November 2018, following a drop of 2.5% in the previous month.

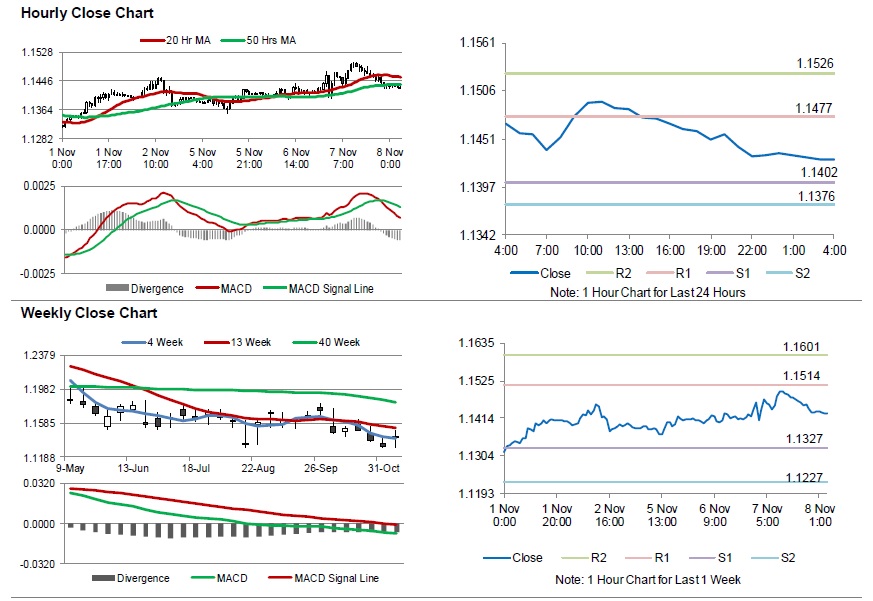

In the Asian session, at GMT0400, the pair is trading at 1.1428, with the EUR trading a tad lower against the USD from yesterday’s close.

The pair is expected to find support at 1.1402, and a fall through could take it to the next support level of 1.1376. The pair is expected to find its first resistance at 1.1477, and a rise through could take it to the next resistance level of 1.1526.

Looking ahead, traders would await Germany’s trade balance data for September, set to release in a while. Later in the day, the US initial jobless claims followed by Federal Reserve’s interest rate decision, will keep investors on their toes.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.