For the 24 hours to 23:00 GMT, the EUR declined 0.25% against the USD and closed at 1.1406.

On the macro front, the Euro-zone’s final services PMI remained unchanged at a level of 51.2 in January, notching its lowest level since November 2014 and defying market expectations for a fall to a level of 50.8. The preliminary figures had indicated a drop to 50.80. Meanwhile, the region’s seasonally adjusted retail sales retreated 1.6% on a monthly basis in December, driven by sharp decline in sales of non-food items such as clothing and footwear and internet purchases and at par with market expectations. In the previous month, retail sales had registered a revised advance of 0.8%.

Separately, in Germany’s, the final services PMI advanced to a level of 53.0 in January, compared to a level of 51.8 in the previous month. The preliminary figures and market participants had envisaged the PMI to rise to a level of 53.1.

In the US, data showed that the US final Markit services PMI declined to a level of 54.2 in January, meeting market anticipation and confirming preliminary figures. The PMI had registered a reading of 54.4 in the prior month.

In the Asian session, at GMT0400, the pair is trading at 1.1400, with the EUR trading 0.05% lower against the USD from yesterday’s close.

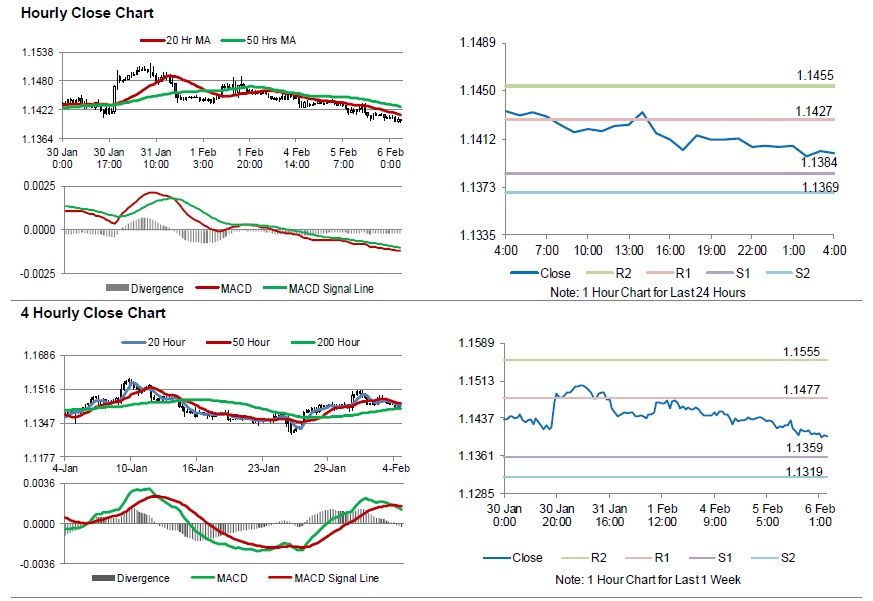

The pair is expected to find support at 1.1384, and a fall through could take it to the next support level of 1.1369. The pair is expected to find its first resistance at 1.1427, and a rise through could take it to the next resistance level of 1.1455.

Looking ahead, traders would keep an eye on Germany’s factory orders for December, set to release in a few hours. Later in the day, the US trade balance data for November along with the MBA mortgage applications, will be on investors radar.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.