For the 24 hours to 23:00 GMT, the EUR traded flat against the USD and closed at 1.1287.

On the data front, the Euro-zone’s seasonally adjusted retail sales unexpectedly dropped 0.3% on a monthly basis in May, compared to a revised fall of 0.1% in the prior month. Market participants had envisaged the retail sales to record a gain of 0.3%.

Separately, in Germany, the construction PMI declined to a level of 50.0 in June, falling to its weakest level since October 2018 and following a reading of 51.4 in the preceding month.

In the Asian session, at GMT0300, the pair is trading at 1.1280, with the EUR trading 0.06% lower against the USD from yesterday’s close.

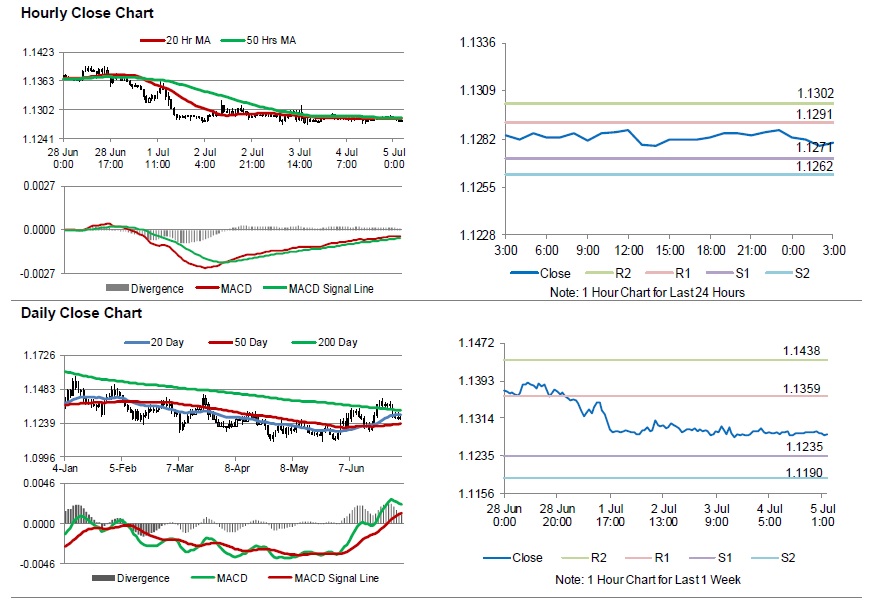

The pair is expected to find support at 1.1271, and a fall through could take it to the next support level of 1.1262. The pair is expected to find its first resistance at 1.1291, and a rise through could take it to the next resistance level of 1.1302.

Moving ahead, traders would keep an eye on Germany’s factory orders for May, slated to release in a few hours. Later in the day, the US non-farm payrolls, unemployment rate and average hourly earnings, all for June, will garner significant amount of investors’ attention

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.