For the 24 hours to 23:00 GMT, the EUR rose 0.24% against the USD and closed at 1.1107 on Friday.

On the data front, Euro-zone’s retail sales advanced 1.1% on a monthly basis in June, surpassing market consensus for a rise of 0.2%. In the prior month, retail sales had recorded a revised fall of 0.6%. Moreover, the region’s producer price index (PPI) rose 0.7% on an annual basis in June, less than market expectations for a rise of 0.8%. In the previous month, the PPI had reported an increase of 1.6%.

The US dollar declined against its major peers, amid dismal US jobs data.

In the US, data showed that the non-farm payrolls increased by 164.0K in July, undershooting market expectations for an advance of 165.0K. In the preceding month, the non-farm payrolls had recorded a reading of 193.0K. Also, the US factory orders rose 0.6% in June, less than market consensus for a rise of 0.7%. In the prior month, factory orders had registered a revised drop of 1.3% in the previous month. Moreover, the final Michigan consumer sentiment index rose to 98.40 in July, less than market expectations. The index had registered a reading of 98.20 in the prior month. The preliminary figures had also recorded a rise to 98.40. Additionally, trade deficit narrowed less-than-anticipated to $55.20 billion in June, compared to a revised deficit of $55.30 billion in the previous month. On the other hand, the nation’s average hourly earnings climbed 3.2% on a yearly basis in July, compared to a reading of 3.1% in the prior month. Moreover, the final durable goods orders recorded a rise of 1.9% on a monthly basis in June. Durable goods orders had registered a revised drop of 2.3% in the prior month. The preliminary figures had recorded an advance of 2.0%. Meanwhile, the US unemployment rate remained unchanged at 3.7% in July.

In the Asian session, at GMT0300, the pair is trading at 1.1124, with the EUR trading 0.16% higher against the USD from Friday’s close.

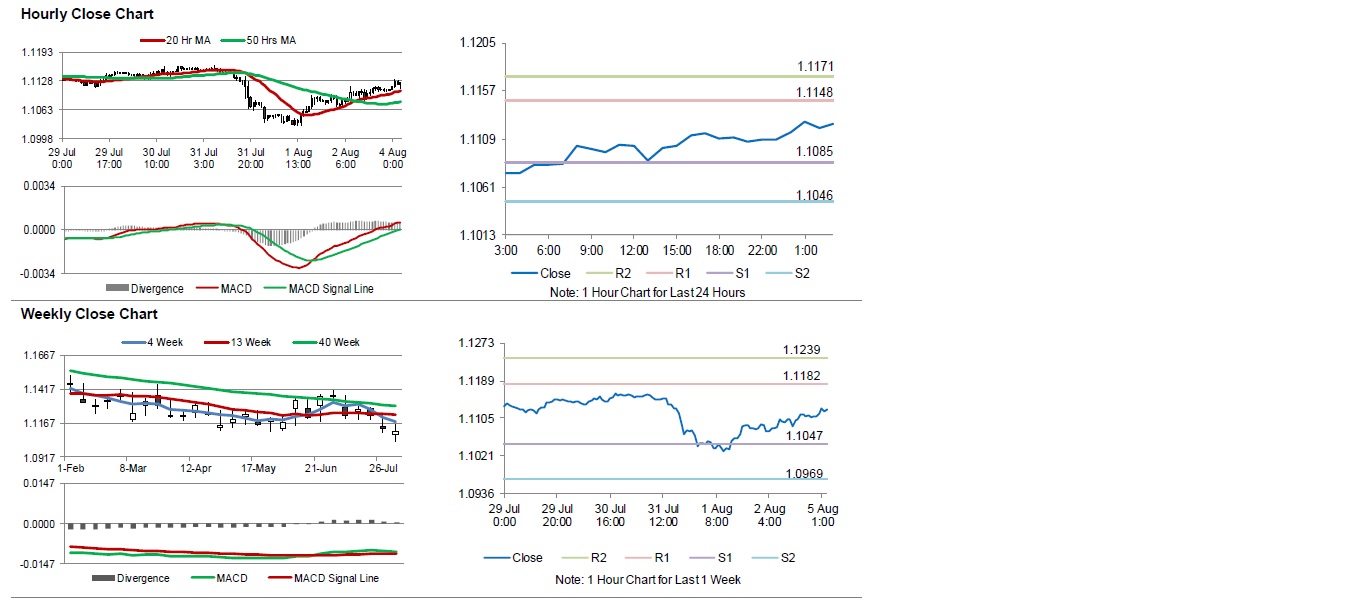

The pair is expected to find support at 1.1085, and a fall through could take it to the next support level of 1.1046. The pair is expected to find its first resistance at 1.1148, and a rise through could take it to the next resistance level of 1.1171.

Moving ahead, traders would keep an eye on the Markit services PMI for July, set to release across the euro bloc along with Euro-zone’s Sentix investor confidence index for August, slated to release in a few hours. Later in the day, the US Markit services PMI and ISM non-manufacturing/services composite, both for July, will be on traders’ radar.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.