For the 24 hours to 23:00 GMT, the EUR declined 0.22% against the USD and closed at 1.1492, amid looming concerns over Italy’s budget deficit.

On the data front, Euro-zone’s Sentix investor confidence index dropped to a level of 11.4 in October, amid uncertainties over Italy’s policy stance and more than market consensus for a fall to a level of 11.6. In the prior month, the index had registered a reading of 12.0.

Additionally, in Germany, seasonally adjusted industrial production unexpectedly eased 0.3% on a monthly basis in August, falling for the third consecutive month, driven by losses in the construction sector. In the previous month, industrial production had declined 1.1%, while market participants had envisaged to record a gain of 0.3%.

In the Asian session, at GMT0300, the pair is trading at 1.1493, with the EUR trading marginally higher against the USD from yesterday’s close.

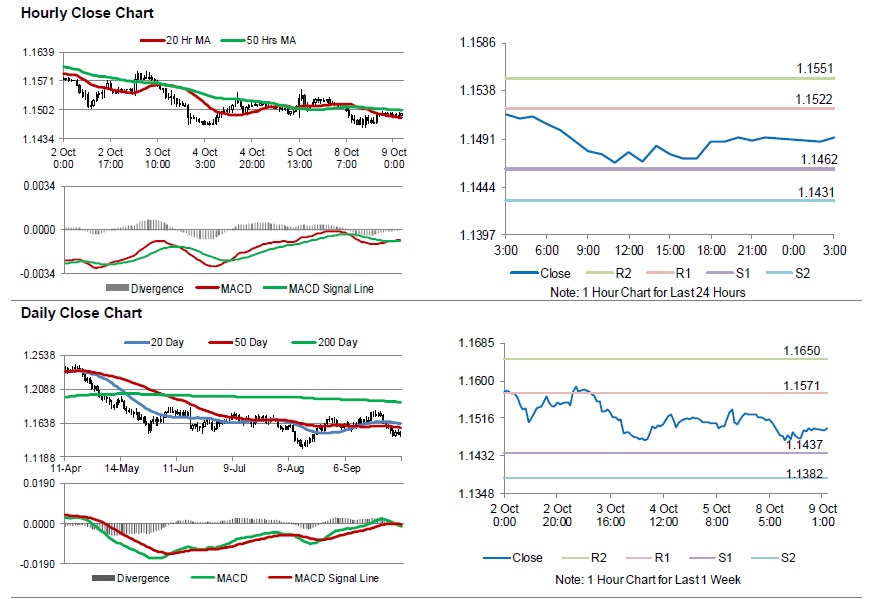

The pair is expected to find support at 1.1462, and a fall through could take it to the next support level of 1.1431. The pair is expected to find its first resistance at 1.1522, and a rise through could take it to the next resistance level of 1.1551.

Looking ahead, traders would await Germany’s trade balance data for August set to release in a while. Additionally, the US NFIB small business optimism index for September, scheduled to release later in the day, will pique significant amount of investor attention.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.