For the 24 hours to 23:00 GMT, the EUR rose 0.2% against the USD and closed at 1.0598, after the Euro-zone’s Sentix investor confidence index advanced to a level of 23.9 in April, strengthening to its highest level in almost a decade as investors emancipated themselves from uncertainty surrounding the French Presidential election. Markets were expecting the index to rise to a level of 21.0, after recording a level of 20.7 in the prior month.

The greenback traded higher lower against a basket of major currencies, after the Federal Reserve (Fed) Chairwoman, Janet Yellen, struck a cautious tone, stating that it would be appropriate to raise interest rates gradually if the economy continues to perform well. Nevertheless, she also added that the US economy is healthy and the Fed is close to reaching its policy objectives.

On the data front, the US labour market conditions index dropped more-than-anticipated to a level of 0.4 in March, compared to a revised level of 1.5 in the preceding month, while investors had envisaged the index to drop to a level of 0.8.

In the Asian session, at GMT0300, the pair is trading at 1.0583, with the EUR trading 0.14% lower against the USD from yesterday’s close.

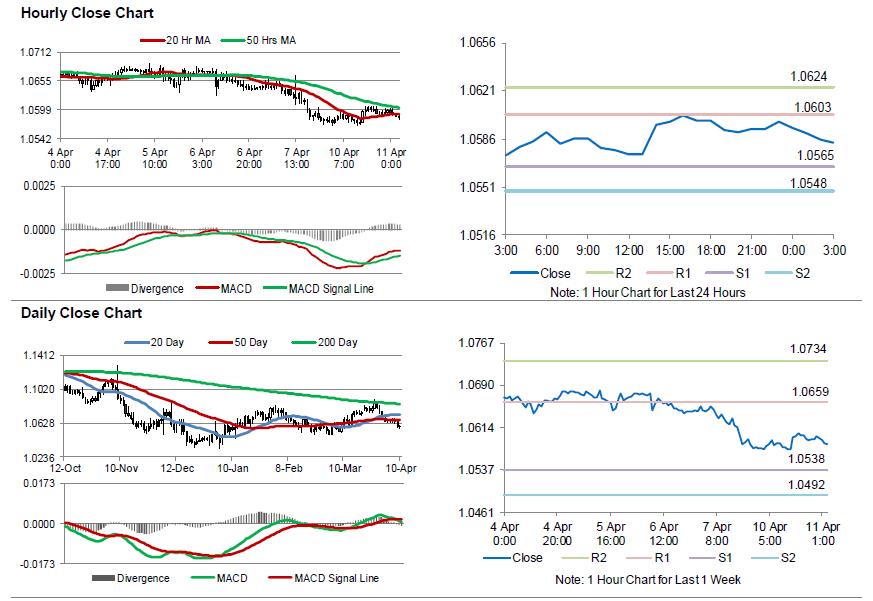

The pair is expected to find support at 1.0565, and a fall through could take it to the next support level of 1.0548. The pair is expected to find its first resistance at 1.0603, and a rise through could take it to the next resistance level of 1.0624.

Trading trend in the Euro today is expected to be determined by the release of ZEW expectations index for April across the Euro-zone accompanied with the region’s industrial production data for February, slated in a few hours. Moreover, the US NFIB small business optimism index for March, due to release later in the day, will be closely watched by traders.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.