For the 24 hours to 23:00 GMT, the EUR rose 0.07% against the USD and closed at 1.1697, after disappointing investor confidence data.

Data showed that the Euro-zone’s Sentix investor confidence index dropped sharply to a level of 9.3 in June, amid political turmoil in Italy and recording its lowest level since October 2016. Market participants had envisaged the index to drop to a level of 18.5. In the previous month, the index had registered a level of 19.2. Meanwhile, the region’s producer price index (PPI) climbed less-than-anticipated by 2.0% on an annual basis in April, compared to an advance of 2.1% in the previous month, while markets were anticipating the PPI to increase 2.4%.

In the US, data showed that final durable goods orders in the US fell 1.6% on a monthly basis in April, compared to a drop of 1.7% in the previous month. Also, the nation’s factory orders declined 0.8% MoM in April, following a revised gain of 1.7% in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.1690, with the EUR trading 0.06% lower against the USD from yesterday’s close.

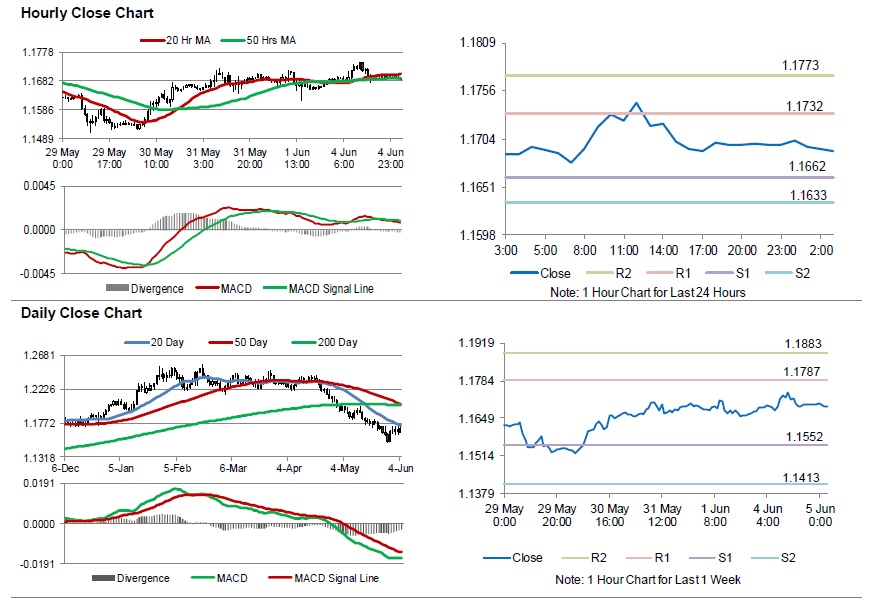

The pair is expected to find support at 1.1662, and a fall through could take it to the next support level of 1.1633. The pair is expected to find its first resistance at 1.1732, and a rise through could take it to the next resistance level of 1.1773.

Going ahead, traders would keep a close watch on the final Markit services PMIs data for May, scheduled to release across the Euro-zone in a few hours. Moreover, the Euro-zone’s retail sales data for April, will also be on investors’ radar. Later in the day, the US ISM non-manufacturing and the final Markit services PMIs, both for May, will pique significant amount of investor attention.

The currency pair is trading below its 20 Hr and showing convergence with its 50 Hr moving average.