For the 24 hours to 23:00 GMT, the EUR rose 0.72% against the USD and closed at 1.0948, following better than expected services PMI data in the Euro-zone and Germany.

Data showed that Euro-zone’s final Markit services PMI unexpectedly rose to a level of 53.3 in February. However, it was the lowest reading in thirteen-months while markets expected it to remain steady at a preliminary print of 53.0. Additionally, the region’s retail sales advanced more-than-anticipated for the third straight month, after it rose by 0.4% MoM in January, compared to market expectations for a rise of 0.1% and recording a revised gain of 0.6% in the preceding month. Meanwhile, Germany’s final Markit services PMI surprisingly advanced to a two-month high level of 55.3 in February, while markets expected it to remain steady at 55.1.

The greenback lost ground, after the US initial jobless claims unexpectedly advanced to 278.0K in the week ended 27 February, following a reading of 272.0K in the previous week and compared to market expectations for a fall to a level of 270.0K. Additionally, the nation’s final Markit services PMI data showed that the service sector contracted for the first time since October 2013 to a level of 49.7 in February, offering signs of worries to the world’s largest economy. The index had recorded a preliminary reading of 49.8, compared to market expectations for a rise to a level of 50.0.

Another set of data showed that the nation’s final durable goods orders rose by 4.7% in January, compared to a reading of 4.9% in the preceding month. Further, factory orders rebounded less-than-expected by 1.6% in January, increasing the most in seven months, compared to a drop of 2.9% in the preceding month.

In the Asian session, at GMT0400, the pair is trading at 1.0945, with the EUR trading marginally lower from yesterday’s close.

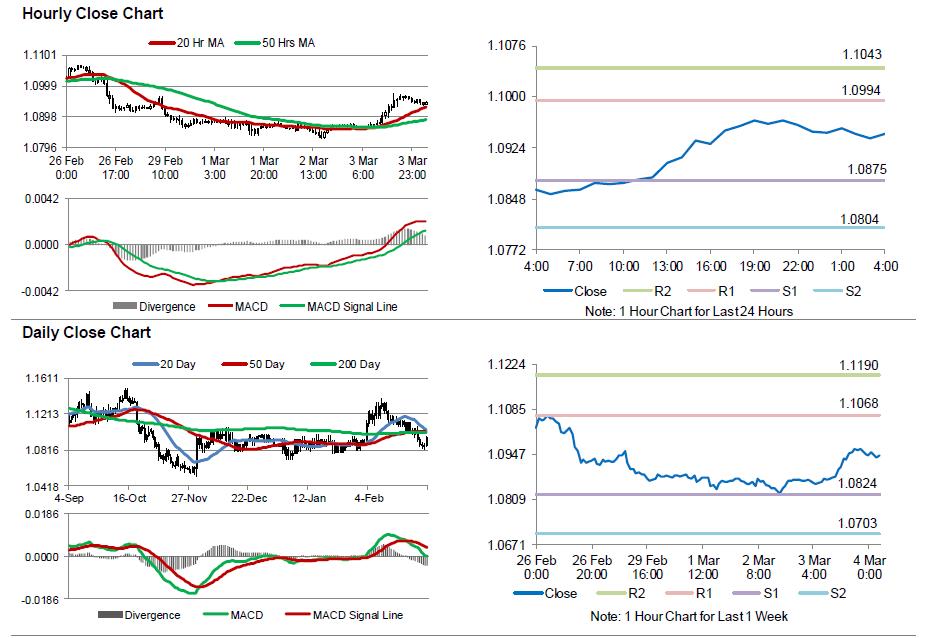

The pair is expected to find support at 1.0875, and a fall through could take it to the next support level of 1.0804. The pair is expected to find its first resistance at 1.0994, and a rise through could take it to the next resistance level of 1.1043.

Moving ahead, investors will look forward to Germany’s Markit construction PMI data for February, slated to release in a few hours. Additionally, the US employment along with non-farm payrolls data, set for release later in the day, will also attract a lot of market attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.