For the 24 hours to 23:00 GMT, the EUR rose 0.12% against the USD and closed at 1.1200.

On Friday, data showed that the Euro-zone’s preliminary consumer price index (CPI) rose 1.7% on an annual basis in April, compared to a climb of 1.4% in the prior month. Market participants had expected the CPI to record a gain of 1.6%.

In the US, data indicated that the non-farm payrolls advanced 263.0K in April, compared to market consensus for an increase of 190.0K. Non-farm payrolls had registered a revised rise of 189.0K in the previous month. Meanwhile, the US final Markit services PMI eased to a level of 53.0 in April, compared to a level of 55.3 in the previous month. The preliminary figures and market participants had envisaged the PMI to fall to a level of 52.9. Moreover, the nation’s non-manufacturing PMI unexpectedly declined to a level of 55.5 in April, compared to a level of 56.1 in the previous month. Markets had anticipated the PMI to advance to a level of 57.0. Also, the US unemployment rate surprisingly slid to a level of 3.6% in April, defying market expectations for an unchanged reading. Unemployment rate had recorded a reading of 3.8% in the previous month.

Yesterday, the Euro-zone’s final services PMI fell to 52.8 in April, registering its lowest level in 3 months, amid slowdown in the manufacturing and services sector and following a level of 53.3 in the prior month. The preliminary figures and market consensus had expected the PMI to drop to a level of 52.5.

On the other hand, the region’s seasonally adjusted retail sales climbed 1.9% in March, surpassing market expectations for a rise of 1.8%. In the prior month, retail sales had risen by a revised 3.0%. Further, the Sentix investor confidence index advanced to a level of 5.3 in May, higher than market expectations for a rise to a level of 1.2 and notching its highest level in 2019. The index had registered a level of -0.3 in the prior month.

Separately, in Germany, the final services PMI climbed to a level of 55.7 in April. The preliminary figures and market participants had anticipated the PMI to advance to a level of 55.6.

In the Asian session, at GMT0300, the pair is trading at 1.1204, with the EUR trading slightly higher against the USD from yesterday’s close.

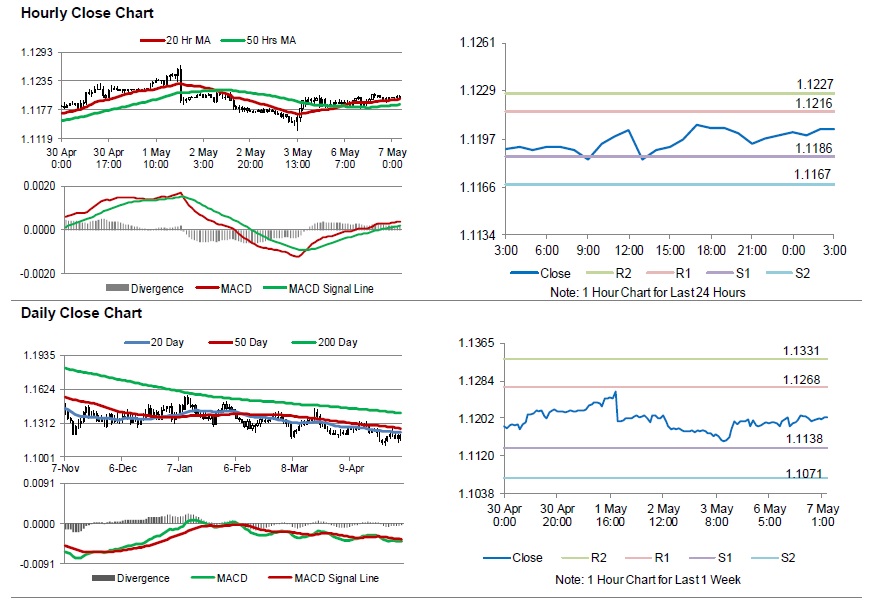

The pair is expected to find support at 1.1186, and a fall through could take it to the next support level of 1.1167. The pair is expected to find its first resistance at 1.1216, and a rise through could take it to the next resistance level of 1.1227.

Looking ahead, traders would await the Germany’s construction PMI for April and factory orders for March, slated to release in a few hours. Later in the day, the US JOLTS Job Openings along with the consumer credit for March, will be on investors radar.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.